Where Natural Gas ETFs Stood next to Natural Gas Last Week

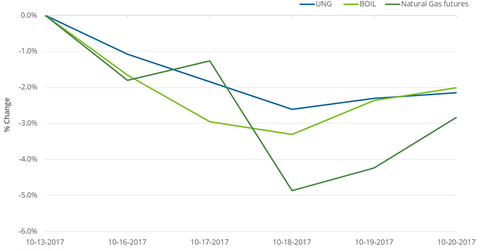

Between October 13 and October 20, 2017, the United States Natural Gas Fund LP (UNG) fell 2.2%, and natural gas November futures fell 2.8%.

Oct. 24 2017, Updated 7:41 a.m. ET

ETFs

Between October 13 and October 20, 2017, the United States Natural Gas Fund LP (UNG) fell 2.2%, and natural gas (GASL) (GASX) (FCG) November futures fell 2.8%. UNG is meant to track natural gas near-month futures contracts. Last week (ended October 20), UNG fell less than natural gas futures.

The ProShares Ultra Bloomberg Natural Gas (BOIL) fell 2% over this same time period. The objective of BOIL is to deliver two times the daily changes of the Bloomberg Natural Gas Subindex.

Natural gas active futures

On March 3, 2016, natural gas active futures plunged to their 17-year lowest closing price. Between March 3, 2016, and October 20, 2017, natural gas active futures rose 77.9%, but UNG rose only 10% during this period, while BOIL fell 6.2% over this time period. The negative roll yield could be the factor that limited the upside in these two ETFs.

UNG shifts its holdings in active natural gas futures to the following month’s futures contract if the active futures contract expiry is within two weeks. So if the following month’s futures contract is priced higher than the near-month futures contract, it could diminish the returns of these ETFs. In this case, the roll-yield would be negative.

BOIL’s daily price performance

Apart from the roll yield, the compounding of BOIL’s daily price performance over a long-time period could cause its yield to differ from its targeted return this period.

On October 20, 2017, natural gas futures contracts out to February 2018 settled at progressively higher prices. To understand the effect of the shape of the futures forward curve on US natural gas prices, check out Market Realist’s analysis of this relationship.

In the next and final part of this series, we’ll focus on the key energy events this week (ended October 27).