What Are Mining Stock Technical Indicators Telling Us?

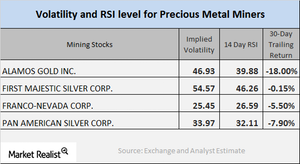

On September 29, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

Oct. 3 2017, Updated 4:06 p.m. ET

Technical analysis

When reading mining stock performances, it’s important to look closely at the details. Most mining stocks retreated on Friday, September 28, just as precious metals did. Here, we’ll look at call implied volatility and RSI (relative strength index) levels and compare Alamos Gold (AGI), First Majestic Silver (AG), Franco-Nevada (FNV), and Pan American Silver (PAAS).

Implied volatility

Call implied volatility is a measurement tool used for reading the changes in the price of a stock with respect to the changes in the price of its call option. On September 29, 2017, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

Notably, volatility in mining shares can frequently be higher than the volatilities of precious metals.

RSI indicator

RSI is used to measure whether a stock has been overbought or oversold. If a stock’s RSI is higher than 70, it may be overbought, and its price may fall. If a stock’s RSI is below 30, it could be oversold and might rise.

Alamos, First Majestic Silver, Franco-Nevada, and Pan American now have RSI levels of 39.9, 46.3, 26.6, and 32.1, respectively. The recent decline in these stock prices has led to a considerable fall in their RSIs.

Notably, the Direxion Daily Gold Miners (NUGT) and the ProShares Silver Trust (AGQ)—both leveraged mining funds—have fallen 5.7% and 4%, respectively, over the past week due to the slump in precious metal prices.