Understanding the Natural Gas Futures Spread—And What It Means for Prices

On October 25, 2017, natural gas December 2018 futures closed $0.11 above the December 2017 futures.

Oct. 26 2017, Updated 12:36 p.m. ET

Futures spread

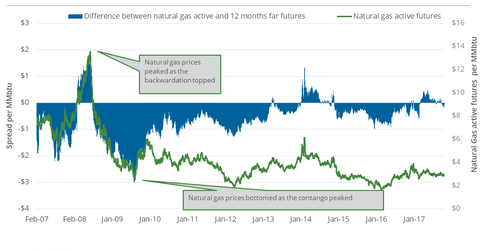

On October 25, 2017, natural gas December 2018 futures closed $0.11 above the December 2017 futures. The difference between the two futures is referred to as the futures spread.

That day, the futures spread was thus at a premium of $0.11. On October 18, the futures spread was at a premium of ~$0.12. In the seven calendar days leading up to October 25, natural gas futures rose 0.6%.

Premium

A rise in the premium may cause natural gas gains to evaporate or, at least, hint at a rising bearish sentiment. For example, on March 3, 2016, the premium was at $0.84, which meant that natural gas active futures were at a 17-year-low closing level. Any fall in this premium could add bullishness to natural gas futures.

Discount

On the other hand, any rise in the discount could cause natural gas to advance. For example, on May 12, 2017, the discount was at $0.5, which meant that natural gas active futures were at a high closing level for the year. Conversely, any fall in the discount could evaporate natural gas gains.

In the trailing week, the premium contracted. Natural gas futures rose during that same period.

Energy stocks

US natural gas producers’ (XOP) (DRIP) (IEO) hedging decisions could be impacted by the natural gas futures’ forward curve. Similarly, the curve is also important for midstream natural gas transportation, storage, and processing companies (AMLP).

On October 25, 2017, natural gas December 2017 futures were trading $0.12 below the January 2018 futures. For this reason, ETFs such as the ProShares Ultra Bloomberg Natural Gas (BOIL) and the United States Natural Gas Fund LP (UNG) could underperform natural gas futures, because such funds lose money during the rollover of their holdings to active futures.

On October 25, 2017, natural gas futures contracts for delivery until February 2018 settled at progressively higher prices.