Reading the Natural Gas Futures Spread: Rising Oversupply Concerns

On October 11, 2017, the futures spread was at a premium of $0.13. Between then and October 18, natural gas November futures fell 1.2%.

Oct. 19 2017, Published 11:58 a.m. ET

Futures spread

On October 18, 2017, natural gas (BOIL) November 2018 futures were trading ~$0.2 above the November 2017 futures, meaning that the futures spread was at a premium of $0.2. The difference between the two futures contracts is referred to as the “futures spread.”

On October 11, 2017, the futures spread was at a premium of $0.13. Between then and October 18, natural gas November futures fell 1.2%.

At a premium

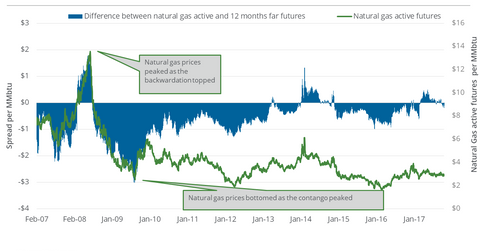

When the futures spread is at a premium—or if there is any expansion in the premium—natural gas prices can fall. On March 3, 2016, the premium rose to $0.84. On the same day, natural gas prices closed at a 17-year low. On the other hand, any fall in the premium could make natural gas prices rise.

At a discount

When the futures spread is at a discount, or if there is any expansion in the discount, then natural gas prices may rise. For example, on May 12, 2017, the discount rose to $0.5. On the same day, natural gas prices closed at their 2017 high. Similarly, any fall in the discount could make natural gas prices fall.

Last week, the premium expanded and natural gas prices fell, which could be pointing toward rising concerns about natural gas’s oversupply.

Energy stocks

Notably, natural gas producers (XOP) (DRIP) (IEO) could take hints from the natural gas futures forward curve shape for hedging-related decisions. The curve also influences midstream companies’ (AMLP) natural gas storage, processing, and transportation decisions.

Meanwhile, the fact that natural gas December 2017 futures are trading above November 2017 futures could negatively impact the performance of the United States Natural Gas ETF (UNG), compared with active natural gas futures.

On October 18, 2017, natural gas futures contracts to February 2018 settled at progressively higher prices.