Oil’s Contango: Supply–Demand Fears Could Impact the Market

On October 3, 2017, US crude oil (USL) (OIIL) November 2018 futures settled $0.33 higher than the November 2017 futures.

Nov. 20 2020, Updated 5:28 p.m. ET

Futures spread

On October 3, 2017, US crude oil (USL) (OIIL) November 2018 futures settled $0.33 higher than the November 2017 futures. The difference between the two futures contracts is known as the futures spread.

On September 26, 2017, the November 2018 futures settled $0.14 higher than the November 2017 futures. In other words, the futures spread was at a premium of $0.14 on that day. Between September 26 and October 3, 2017, US crude oil November futures fell 2.8%.

Oil prices and contango

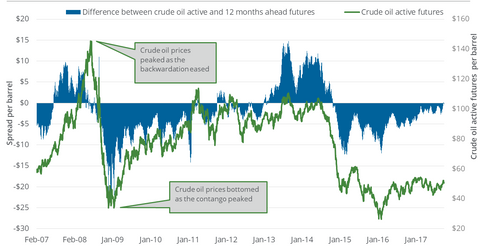

In contango, the futures spread is at a premium. A rise in the premium could coincide with a fall in oil prices and vice versa. For example, the premium was $12.01 when US crude active futures were at their 12-year low on February 11, 2016.

Oil prices and backwardation

In backwardation, the futures spread is at a discount. A rise in the discount could coincide with a rise in oil prices and vice versa. The discount was $10.53 when US crude active futures were at their peak before the last three-year downturn in oil prices on June 20, 2014.

In the trailing week, US crude oil prices fell and the contango rose. This movement could reflect market concerns about supply outpacing demand.

Energy stocks

US crude oil’s futures forward curve is important for the hedging decisions of US oil producers (XOP)(DRIP)(IEO). Given a wide enough contango, oil producers can find selling current production at a future date profitable. These dynamics can also impact midstream (AMLP) oil transportation and storage companies.

On October 3, 2017, US crude oil futures contracts for delivery until April 2018 settled at progressively higher prices. With the positive-sloped futures forward curve, ETFs that track US crude oil futures could rise less compared to active crude oil futures. These funds include the United States Oil Fund LP ETF (USO), the United States 12 Month Oil Fund LP (USL), and the ProShares Ultra Bloomberg Crude Oil ETF (UCO).