How Gilead’s HIV and HBV Portfolios Performed in 2Q17

Gilead Sciences’ (GILD) portfolio includes various drugs for key therapeutic areas including HIV/AIDS, liver diseases, oncology, cardiovascular, inflammation, respiratory, and others.

Sept. 11 2017, Updated 12:05 p.m. ET

Gilead’s portfolio

Gilead Sciences’ (GILD) portfolio includes various drugs for key therapeutic areas including HIV/AIDS, liver disease, oncology, cardiovascular, inflammation, respiratory, and others. Antiviral products including HIV products and liver disease products contribute over 90% of Gilead’s total revenues.

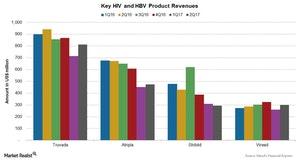

The above chart shows revenues from key HIV and hepatitis B virus (or HBV) products over the last few quarters.

HIV and HBV drugs portfolio

The HIV drugs and HBV drugs portfolio includes drugs like Truvada, Atripla, Viread, Stribild, Complera, Genvoya, Descovy, Odefsey, and other products. The key drugs include Genvoya, Truvada, Atripla, Viread, and Stribild.

Genvoya

Genvoya is one of the blockbusters from Gilead’s HIV portfolio. Genvoya is approved for use as a first-line treatment for the HIV-1 infection as well as a replacement for the patient’s existing treatment for HIV-1 infection. Genvoya reported revenues of $857 million during 2Q17, an 184% increase as compared to revenues of $302 million during 2Q16.

Truvada

Truvada, another blockbuster drug from Gilead’s HIV franchise, is approved for use in combination with other antiretroviral agents for the treatment of the HIV-1 infection, and it’s also used to reduce the risk of sexually acquired HIV-1 infections. Truvada reported revenues of $812 million during 2Q17, a 14% decline as compared to $942 million in 2Q16.

Atripla

Atripla is used as a monotherapy and also in combination with other antiretroviral agents for the treatment of patients with HIV-1. Atripla reported revenues of $475 million during 2Q17, a 29% decline as compared to $673 million during 2Q16.

Viread

Viread is approved in combination with other antiretrovirals for the treatment of HIV-1 and also approved for the treatment of the HBV infection. However, the drug Viread should not be used in combination with other drugs like Truvada, Atripla, Stribild, and Complera. Viread reported revenues of $300 million during 2Q17, a 5% growth as compared to revenues of $287 million during 2Q16.

Stribild

Stribild is used for the treatment of HIV-1 in patients with no antiretroviral treatment history and also as a replacement for existing antiretroviral treatments. Stribild reported revenues of $293 million during 2Q17, a 32% decline as compared to $429 million during 2Q16.

Other similar drugs are Tivicay from GlaxoSmithKline (GSK), Evotaz from Bristol-Myers Squibb, Isentress from Merck (MRK), and Prezcobix from Johnson & Johnson (JNJ).

To divest company-specific risks, investors can consider ETFs like the VanEck Vectors Biotech ETF (BBH), which holds 11.3% of its total assets in Gilead Science.