How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

Oct. 30 2017, Updated 11:10 a.m. ET

US dollar continues to surge higher

The US Dollar Index (UUP) continued its ascent last week. The US Dollar Index posted a weekly close of 94.7, appreciating by 1.3% and posting the best weekly gain since the US election week last year. Positive economic data, the confirmation of a rate hike, and President Trump’s tax reform plans are the reasons behind the US dollar’s rise this week. Rising US bond yields also supported the US dollar’s ascent last week.

Speculators remained bullish for four weeks in a row

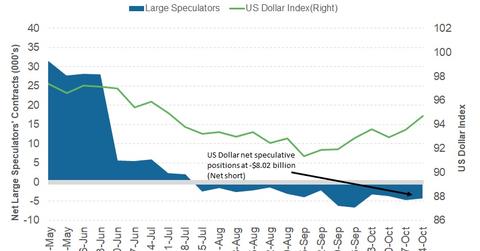

As per the latest Commitment of Traders (or COT) report released on October 27 by the Chicago Futures Trading Commission (or CFTC), large speculators and traders increased their bullish bets on the US dollar. Bullish bets are at their highest level in the last 12 weeks, but the overall net positions remain on the short side.

As per Reuters calculations, the US dollar (USDU) net short positions fell to -$8.0 billion as compared to -$12.7 billion in the previous week. This amount is a combination of the US dollar’s contracts against the combined contracts of the euro (FXE), the British pound (FXB), the Japanese yen (FXY), the Australian dollar (FXA), the Canadian dollar (FXC), and the Swiss franc.

Outlook for the US dollar

Further developments in US tax reforms and economic performance could lead to a decline in bearish bets against the US dollar. It’s an action-packed week for the US dollar as politics, the Fed, and economic data are on the radar. The FOMC statement is expected to be hawkish and cement the December rate hike. Plus, economic data in the form of personal income, spending, and PMI reports could improve from the Hurricane-related slump. Overall, this week could be another positive week for the US dollar.

In the next part of this series, we’ll discuss the performance of the US bond markets in the previous week and how bond yields could move.