Why ConocoPhillips Stock Moved Last Week

For the week ending September 29, 2017, ConocoPhillips stock had a correlation of ~18% with crude oil (USO) (SCO).

Oct. 3 2017, Updated 1:06 p.m. ET

ConocoPhillips’s correlations last week

As we saw in the previous part, ConocoPhillips’s (COP) stock price rose ~2% last week. Crude oil (OIL) (SCO) and the SPDR S&P 500 ETF (SPY) rose ~2% and ~0.7%, respectively, in the same week. However, natural gas prices fell by close to half a percentage point. In this part, we’ll discuss the relationship between the daily movements of ConocoPhillips’s stock price and crude oil prices. We’ll look at ConocoPhillips stock’s correlation coefficient with crude oil in the past week and the past month. We’ll also discuss the extent to which ConocoPhillips’s stock price followed daily natural gas prices and the S&P 500 Index during the same period.

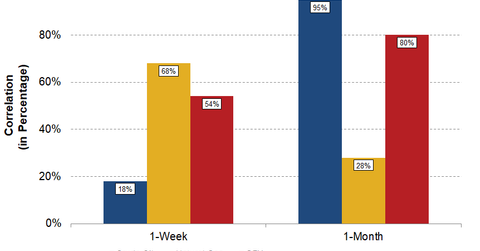

For the week ending September 29, 2017, ConocoPhillips stock had a correlation of ~18% with crude oil (USO) (SCO). It meant that in the last five days, the aggregate daily movements in crude oil had a minimal influence on ConocoPhillips stock. Even though crude oil prices have taken a breather since Tuesday last week, ConocoPhillips’s stock price rose until Thursday. However, most of the gains in ConocoPhillips came on Monday when crude oil prices rose almost 3%.

In contrast to crude oil, ConocoPhillips stock’s correlations with natural gas (UNG) and the SPDR S&P 500 ETF (SPY) were stronger at ~68% and ~54%, respectively, during the same period. The movements in ConocoPhillips stock were in tandem with natural gas or the S&P 500 Index last week.

ConocoPhillips stock had correlations of ~95%, ~28%, and ~80% with crude oil (USO), natural gas (UNG) and SPY’s prices, respectively, in the past month.

ConocoPhillips’s peers

ConocoPhillips’s peer Occidental Petroleum (OXY) had a correlation of ~23% with crude oil prices last week. However, it still rose ~2% due to the rise in crude prices. Most of the gains in Occidental Petroleum came on Monday when crude oil prices rose almost 3%. In the rest of the week, crude oil prices were consolidating with slight negative bias. Occidental Petroleum stock still had a slightly positive bias on Thursday. Even though the weekly gains in Occidental Petroleum can be attributed to the rise in crude oil prices, its correlation with crude oil in the last five days was at a much lower value.

Occidental Petroleum had a correlation of ~77% and approximately -9% with natural gas and SPY last week. Occidental Petroleum’s production mix contains ~75% crude oil. As a result, crude oil prices have a high influence on Occidental Petroleum’s stock price.

To learn more about the correlation of various upstream stocks with various energy commodities, read How Correlations with Energy Commodities Impact Upstream Stocks.