Forecasting Apache’s Stock Price Range

The current implied volatility in Apache’s stock (APA) is ~37.79%. In comparison, the Energy Select Sector SPDR ETF (XLE) has an implied volatility of 17.8%.

July 23 2018, Updated 7:33 a.m. ET

Apache’s implied volatility

The current implied volatility in Apache stock (APA) is ~37.79%. In comparison, the Energy Select Sector SPDR ETF (XLE) has an implied volatility of 17.8%.

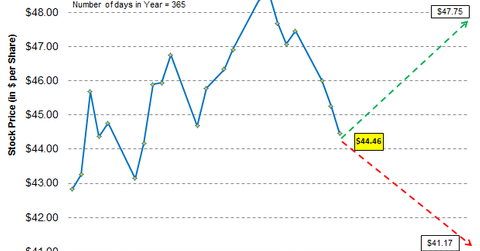

Stock price forecasts

Apache’s implied volatility of ~37.79% can be used to forecast its stock range in the next two weeks or around its scheduled earnings release date of August 1. Assuming a normal distribution of prices with one standard deviation, Apache stock will likely close between $41.17 and $47.75 in the next two weeks. The stock will probably stay in this range 68% of the time. Currently, Apache stock is trading at $44.46.

In comparison, Hess (HES) stock is expected to range between $59.99 and $69.01 based on an implied volatility of ~35.69% during the same period.

Concho Resources (CXO) has a stock range forecast of $138.27–$158.27 based on an implied volatility of 34.44% in the next two weeks. During the same period, Continental Resources (CLR) will likely close between $56.82 and $66.68 based on an implied volatility of 40.74%.

Next, we’ll discuss analysts’ recommendations for Apache.