Analyzing the Natural Gas Futures Spread

On December 18, the natural gas futures for January 2019 closed at a premium of ~$0.7 to the January 2020 futures.

Nov. 20 2020, Updated 12:46 p.m. ET

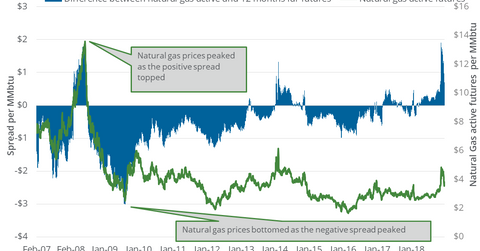

Futures spread

On December 18, the natural gas futures for January 2019 closed at a premium of ~$0.7 to the January 2020 futures. On December 11, the futures spread was at a premium of $1.2. On December 11–18, the natural gas January futures fell 12.9%.

Sentiments for natural gas

The market sentiment toward natural gas’s demand-supply situation is reflected in the futures spread. The futures spread and natural gas prices tend to move in the same direction.

In the past five trading sessions, the premium contracted and natural gas prices fell by almost 13 percentage points. The premium might have contracted due to the expectation of lower total degree days in the past, which we discussed in Part 1. In the previous part, we saw that natural gas inventories are at a double-digit deficit in percentage terms compared to their five-year average—a factor that might push the spread higher in the coming days.

Energy stocks

The natural gas January futures fell 12.9% in the trailing week. During this period, natural gas–weighted stocks Southwestern Energy (SWN), Chesapeake Energy (CHK), Range Resources (RRC), and Gulfport Energy (GPOR) fell 13.4%, 14.3%, 15%, and 20.5%, respectively, and underperformed their peers.

Forward curve

As of December 18, the natural gas futures contracts for delivery between January and May 2019 were priced in descending order, which is a positive development for ETFs that follow natural gas futures including the ProShares Ultra Bloomberg Natural Gas ETF (BOIL) and the United States Natural Gas ETF (UNG).