What Factors Could Drive Arch Coal Stock in 2H17?

1H17 in review Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017. On September 19, 2017, Arch Coal (ARCH) has fallen […]

Nov. 20 2020, Updated 3:08 p.m. ET

1H17 in review

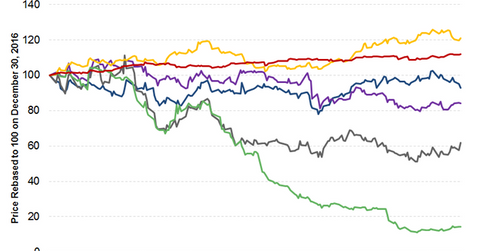

Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017.

On September 19, 2017, Arch Coal (ARCH) has fallen nearly 7% so far in 2017. Its peers Cloud Peak Energy (CLD) and Alliance Resource Partners (ARLP) lost 62% and 19%, respectively, year-to-date (YTD). Westmoreland Coal (WLB) has lost 86% so far this year.

The SPDR S&P 500 ETF (SPY), which tracks the broad-based US markets, rose nearly 12%. The VanEck Vectors Coal ETF has gained nearly 21%, outperforming all these stocks YTD.

Trump administration: Environmental reforms

On March 28, 2017, an executive order was passed to repeal regulations and guidelines put in place by former President Barack Obama to control global climate change. According to the new regulations, the January 2016 moratorium on private companies leasing federal land to coal miners set by the Department of Interior was reversed.

Trump also removed the United States from the Paris Climate Agreement on climate change in June 2017. These reforms are expected to affect the coal industry positively.

Coal’s share in electricity generation

According to the EIA’s (US Energy Information Administration) latest short-term energy outlook, coal and natural gas shares in electricity generation are expected to be almost on par with each other this winter.

The EIA estimates natural gas share in electricity generation in 2017 to be~31%, down from 34% in 2016. This fall in market share is being attributed to higher natural gas prices, increased generation from renewables and coal, and lower electricity demand.

Coal’s share is expected to be ~31% in 2017—higher than its 30% market share in 2016. This could have a positive impact on Arch Coal’s business in 2H17.

In the final article of this series, we’ll compare Arch Coal’s valuation to that of its peers.