These Factors Affected Johnson & Johnson’s Revenues in 2Q17

Johnson & Johnson (JNJ) reported a 2.9% increase in its revenues at constant exchange rates in 2Q17.

Sept. 27 2017, Updated 10:40 a.m. ET

Johnson & Johnson’s revenues

Johnson & Johnson (JNJ) reported a 2.9% increase in its revenues at constant exchange rates in 2Q17. The reported revenues were $18.8 billion, a 1.9% growth in absolute figures as compared to revenues of $18.5 billion during 2Q16.

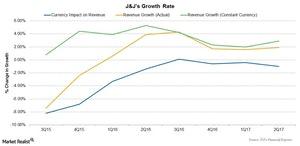

The above graph shows the changes in the growth rate as well as the impact of foreign exchange on the revenues over the last few quarters.

Impact of foreign exchange on revenues

Johnson & Johnson’s business structure includes eight research centers and over 134 manufacturing facilities worldwide. Also, the revenues from sales outside the US markets contribute around 48% of total revenues for the company, which results in larger exposure to currency risk. Therefore, it’s essential to understand the impact of foreign exchange on total revenues. For 2Q17, the company reported a 1% negative impact of foreign exchange on overall revenues.

Factors driving growth

Johnson & Johnson has restructured its business segments over the last few years. Johnson & Johnson’s growth has been driven by drugs like:

- Edurant, Imbruvica, Invega Sustenna/Xeplion, Stelara, and Xarelto from its pharmaceuticals portfolio

- beauty products and wound care products from the consumer portfolio

- advanced surgery products, cardiovascular products, vision care products, and hip, knee, and trauma products from its medical devices portfolio

The company reported growth at constant exchange rates across all three business segments during 2Q17, partly offset by the negative impact of foreign exchange.

To divest company-specific risks, investors can consider ETFs like the SPDR S&P Pharmaceuticals ETF (XPH), which holds 4.3% in Johnson & Johnson. XPH also holds 4.3% in Allergan (AGN), 5.0% in Bristol-Myers Squibb (BMY), and 4.5% in Pfizer (PFE).