The Bond Market’s Reaction to New Rate Hike Hopes

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%.

Sept. 15 2017, Published 1:18 p.m. ET

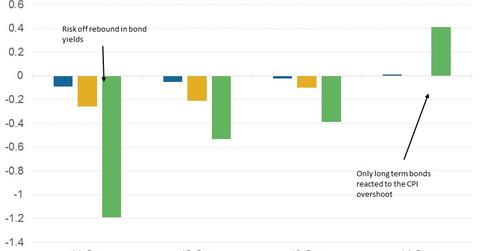

Bond yields swing higher as rate hike hopes resurface

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%. Investors have been long bonds in recent months. The Fed was expected to back down from further rate hikes—at least until 2018. This view met with challenges after the surprising uptick in US inflation (TIP) in August. The probability of a December rate hike, as per the federal funds futures (AGG) data reported by the Chicago Mercantile Exchange (or CME), moved to 55.6% after the inflation data release.

Reasons for the change in expectations

Investors started writing off any expectations for a rate hike after the Fed’s July statement downgraded the outlook for inflation. The Fed is expected to continue with its plans of balance sheet normalization. We could get an announcement at the September meeting set to begin next Tuesday. The US Fed has laid out a plan for the balance sheet unwinding, and a set amount of fixed securities (LQD) wouldn’t be replaced once the program begins.

September meeting in focus

Though the Fed isn’t expected to announce a rate hike, the statement following the meeting should be important. If the Fed sounds hawkish, the chances of a rate hike in December could increase, taking bond (BND) yields higher.