Why Goldman Sachs Is Optimistic about Alibaba

Alibaba was trading at $169 on September 8, 2017. Its 52-week high is $177 and its 52-week low is $86.01.

Nov. 20 2020, Updated 11:24 a.m. ET

Goldman Sachs on Alibaba

Goldman Sachs (GS) discussed its optimistic view on Alibaba (BABA) in a note to clients. The investment firm included the stock in its top e-commerce stock picks.

Alibaba is a leader in China’s e-commerce business. It’s playing a major role in the overall e-commerce business and is one of Amazon’s (AMZN) big competitors. Recently, we saw that billionaire investor Stanley Druckenmiller took a huge position in major Chinese stocks such as Yum China (YUMC) and Alibaba (BABA). These bets reflect his optimism surrounding Chinese consumer stocks. Goldman Sachs expects growth in emerging economies (EEM) (VWO) will pick up quickly, which will benefit stocks like Alibaba.

Goldman Sachs wrote, “Alibaba is China’s largest e-commerce platform, monetizes via an advertising model, is the largest cloud service provider, and is the leading video platform in China.”

Alibaba’s performance

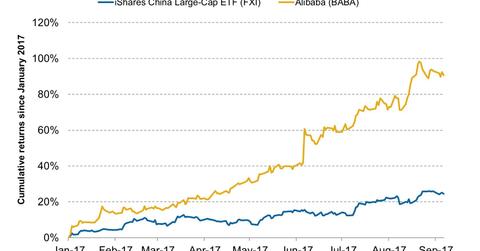

Alibaba was trading at $169 on September 8, 2017. Its 52-week high is $177 and its 52-week low is $86.01. On a year-to-date basis, the stock returned nearly 90.7% as of September 8, 2017. The broader market S&P 500 Index (SPY) returned nearly 9.7% during the same period.

Alibaba is trading 19.3% above its 100-day moving average, 7.4% above its 50-day moving average, and 1.3% above its 20-day moving average. Goldman Sachs has a current target price of $208 for Alibaba.

In the next part of this series, we’ll analyze Goldman Sachs’s view on JD.com (JD).