Futures Spread: Is the Natural Gas Market Turning Bullish?

On September 20, 2017, natural gas (FCG) (BOIL) October 2018 futures closed $0.10 below its October 2017 futures.

Nov. 20 2020, Updated 2:07 p.m. ET

Futures spread

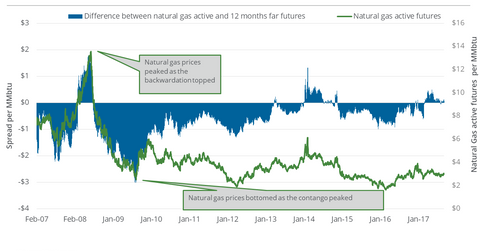

On September 20, 2017, natural gas (FCG) (BOIL) October 2018 futures closed $0.10 below its October 2017 futures. On September 13, 2017, the futures spread was at a discount of $0.08. Between these two dates, natural gas futures rose 1.2%.

Futures spread at a discount

When the futures spread is at a discount, or the discount expands, it could bring bullish momentum in natural gas prices. For example, on May 12, 2017, natural gas futures settled at their 2017 high. On the same day, the discount rose to $0.50. However, if the discount contracts, it could pull natural gas prices down.

Futures spread at a premium

When the futures spread is at a premium, or the premium expands, it could bring bearish momentum in natural gas prices. On March 3, 2016, natural gas futures settled at their 17-year low. On the same day, the premium rose to $0.84. However, if the premium contracts, it could push natural gas prices up.

In the trailing week, the discount expanded and natural gas prices rose as well. It could point to the market’s expectations of the supply-demand dynamics turning bullish.

Energy stocks

The discount in the futures spread could encourage natural gas producers (XOP) (DRIP) to sell their current production now, as opposed to storing it for sale at a future date. It also impacts their hedging-related decisions. The shape of the futures forward curve also affects the natural gas storage, processing, and transportation businesses of midstream (AMLP) companies.

The difference between natural gas’s active futures and the next-month futures could impact the returns of ETFs like the United States Natural Gas ETF (UNG).

Please visit our Energy and Power page for updates and more information about natural gas prices.