China’s Copper Imports: Did Data Spoil Freeport’s Party?

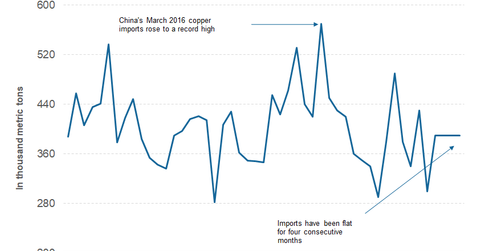

China imported 390,000 metric tons of unwrought copper and copper products in August 2017—compared to 350,000 metric tons in August 2016.

Sept. 11 2017, Updated 9:08 a.m. ET

China’s copper import data

While China is the key driver of global steel and aluminum supply, copper mining is concentrated in Latin America (ILF). Although Latin America holds the sway in the copper supply, China drives the global demand. China accounts for more than 45% of the global copper demand. Several observers see China’s copper imports data as a leading indicator for the country’s copper demand. Let’s see how Chinese copper imports looked in August.

Copper imports in August

China imported 390,000 metric tons of unwrought copper and copper products in August 2017—compared to 350,000 metric tons in the same month last year. Although imports have risen 11.4% on a yearly basis, they’re flat on a month-over-month basis. Notably, August is the fourth consecutive month that China’s unwrought copper imports have been flat on a monthly basis. China’s copper imports data in August dampened the market’s sentiments. As a result, we saw a sell-off in copper prices (BHP).

Copper prices

Notably, copper prices have been strong in the past few months. Better-than-expected global demand, supply issues at leading mines, the weaker US dollar, and China’s announcement to ban certain grades of copper scrap imports boosted the market’s sentiments. Copper miners including Freeport-McMoRan (FCX), Glencore (GLNCY), and Southern Copper (SCCO) have also followed copper higher. However, we saw weakness in copper miners after China’s August copper imports data were released.

In the first eight months of 2017, China’s unwrought copper imports were at ~3.0 million metric tons—a year-over-year fall of 12.5%. However, the steep decline in China’s unwrought copper imports is due to several factors and doesn’t necessarily reflect a demand slowdown.