Why the Euro Is Turning Out to Be a Preferred Safe Haven

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

Aug. 31 2017, Updated 7:38 a.m. ET

Currency market reactions to North Korean aggression

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session. Investors prefer to move to currencies from countries with a current account surplus in uncertain times.

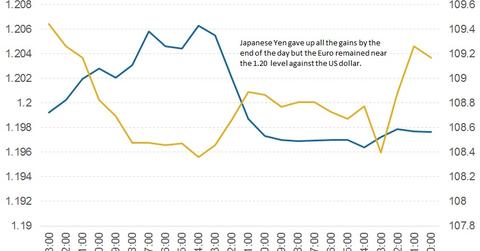

The Japanese yen (YCS) recorded a three-month peak against the US dollar (UUP) at 108.27, and the Swiss franc posted a two-and-half-year peak against the US dollar at 0.94. The US dollar lost ground against many major currencies, indicating that the US dollar isn’t the king of currencies anymore. By the end of the day, most of the gains were wiped out, as risk aversion returned to normal. The euro was the only currency that held onto its gains.

Is the euro now turning into a safe haven?

One interesting recent development in the currency markets has been the evolution of the euro (FXE) as a safe haven. The European Central Bank is raring to reduce its stimulus program, encouraged by improving economic conditions and a relatively stable political climate, so the euro is gaining its place in safe haven currencies. The euro broke the 1.20 level against the US dollar and managed to close at 1.1970.

Outlook for currency markets

For the time being, markets are placing a temporary break on risk aversion. Safe havens like the Japanese yen and Swiss franc could return to recent ranges, but the euro is likely to continue its ascent. Weakness in the US dollar could extend, as the Fed will now have to adjust its policy in response to the economic ramifications of Hurricane Harvey on the US economy.