ProShares UltraShort Yen

Latest ProShares UltraShort Yen News and Updates

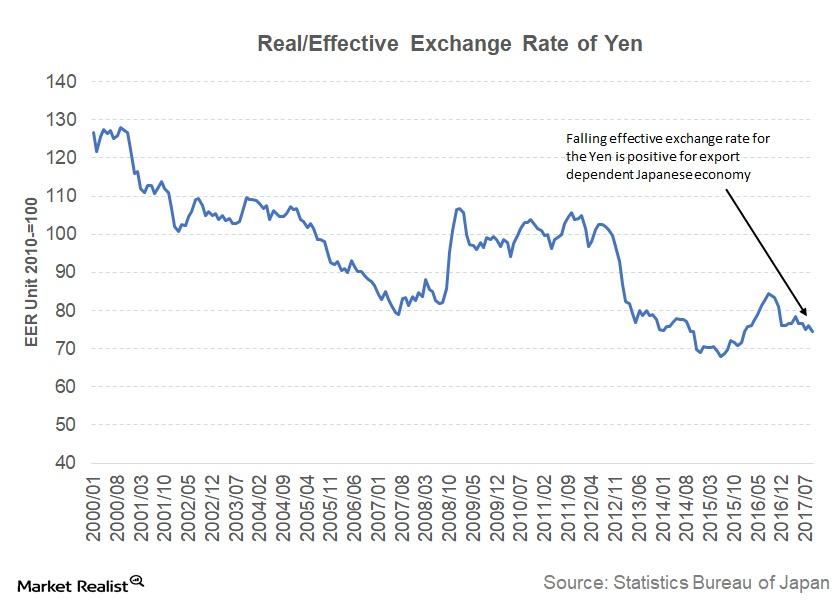

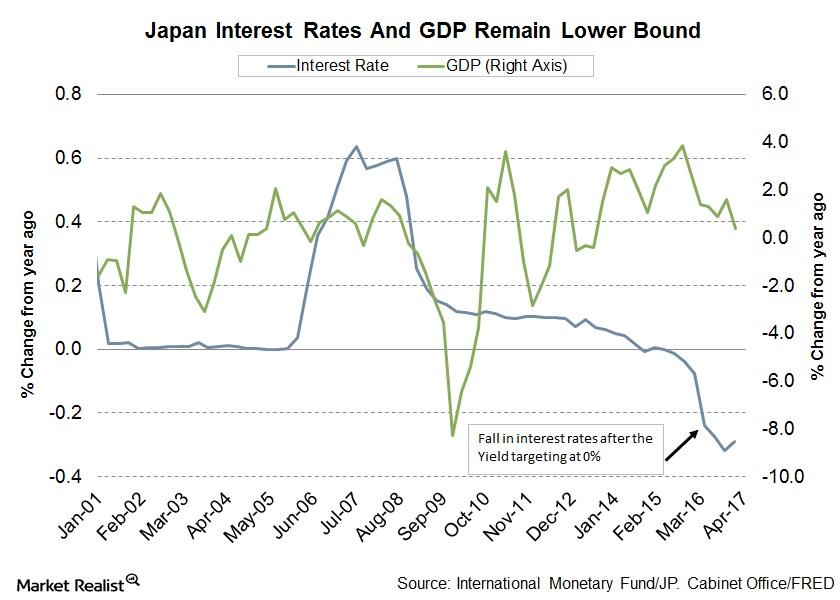

Japanese Yen Is Expected to Depreciate More

Since the Japanese election results, the Japanese yen has depreciated. The Bank of Japan is expected to continue the accommodative policy.

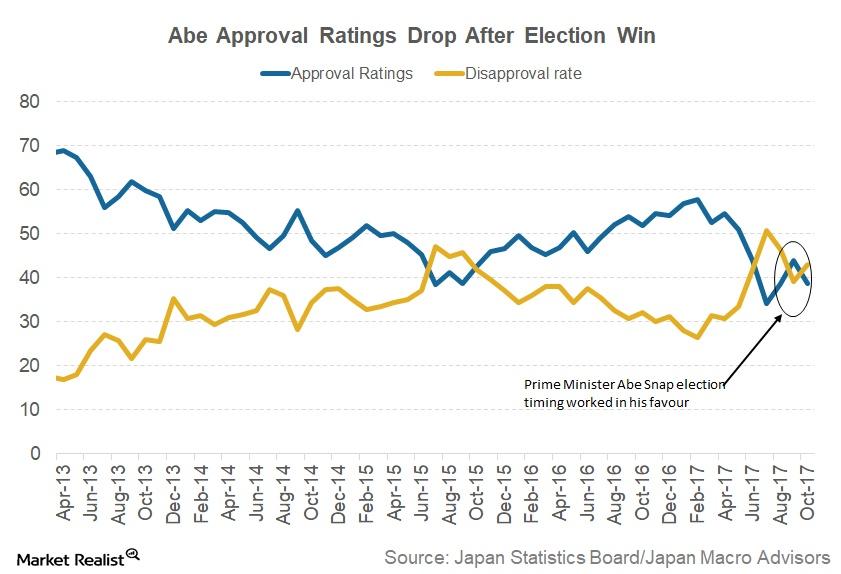

Why the Recent Election Results Are Positive for Japan

Japanese Prime Minister Shinzo Abe’s call for an early election worked in his favor. He called for a snap election to take advantage of his high ratings.

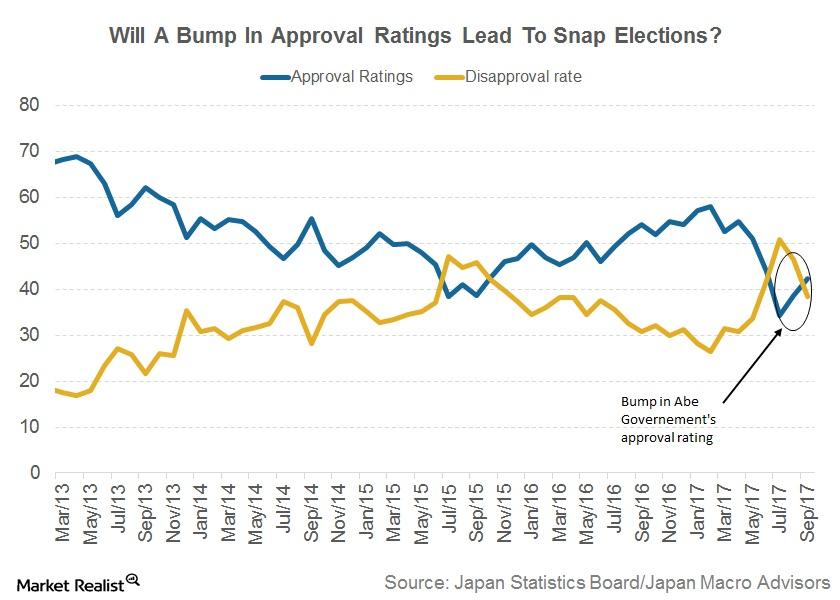

Bank of Japan Sees Rising Political Uncertainty as a Risk

According to news reports, Japanese Prime Minister Shinzo Abe could be calling for a snap election next month to capitalize on the increased approval ratings in August.

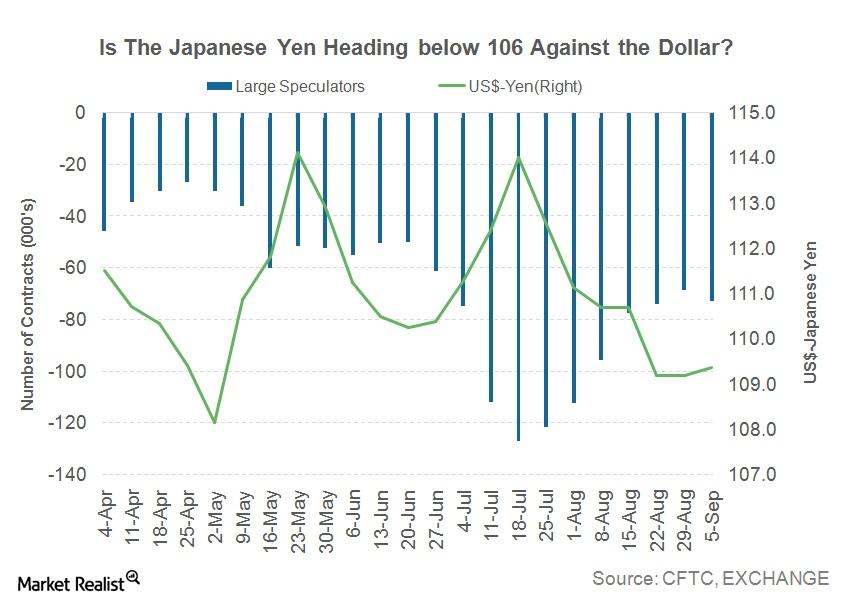

What Drove the Japanese Yen below 108 Last Week?

The Japanese yen gained ground against the US dollar last week, closing at 107.8 against the US dollar, which appreciated 0.56%.

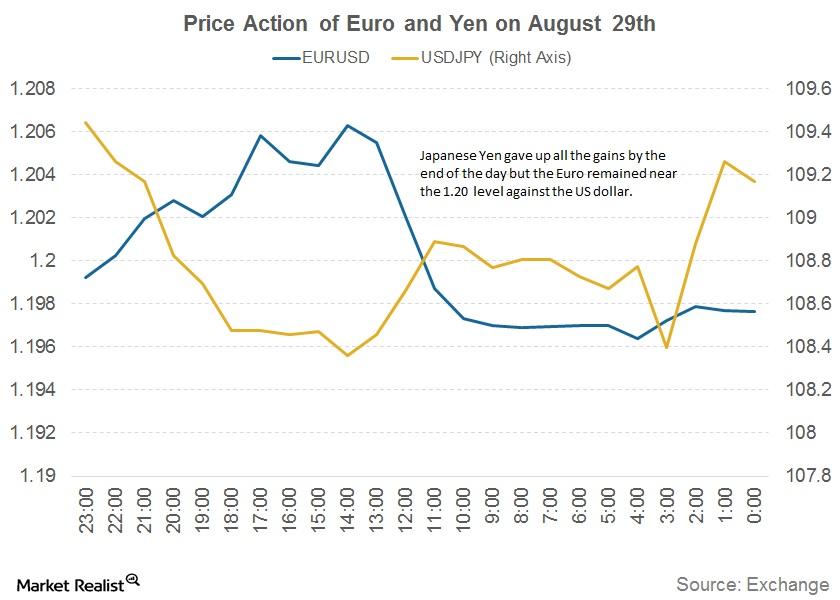

Why the Euro Is Turning Out to Be a Preferred Safe Haven

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

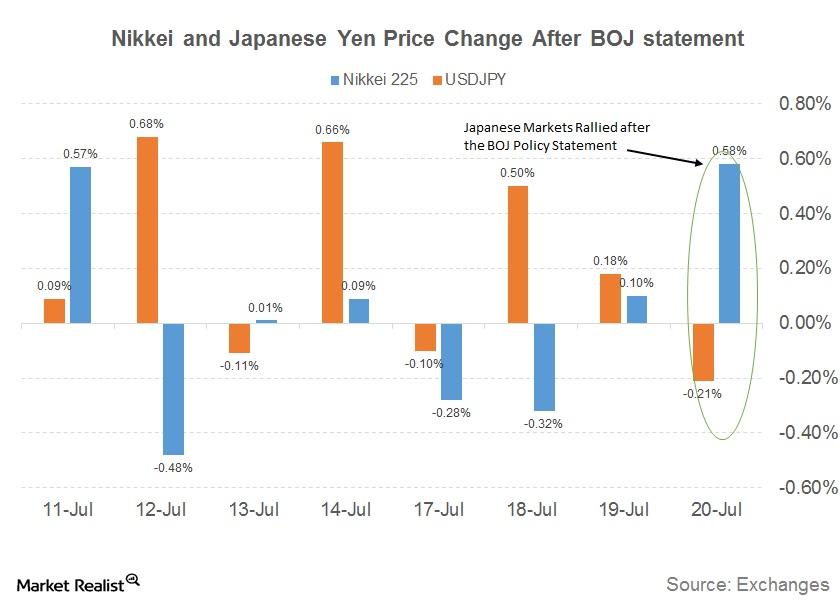

Why Japanese Markets Surged after the Bank of Japan’s Inaction

In its July 2017 monetary policy statement on July 20, 2017, the Bank of Japan reported that it had left interest rates unchanged at -0.1%.

The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.

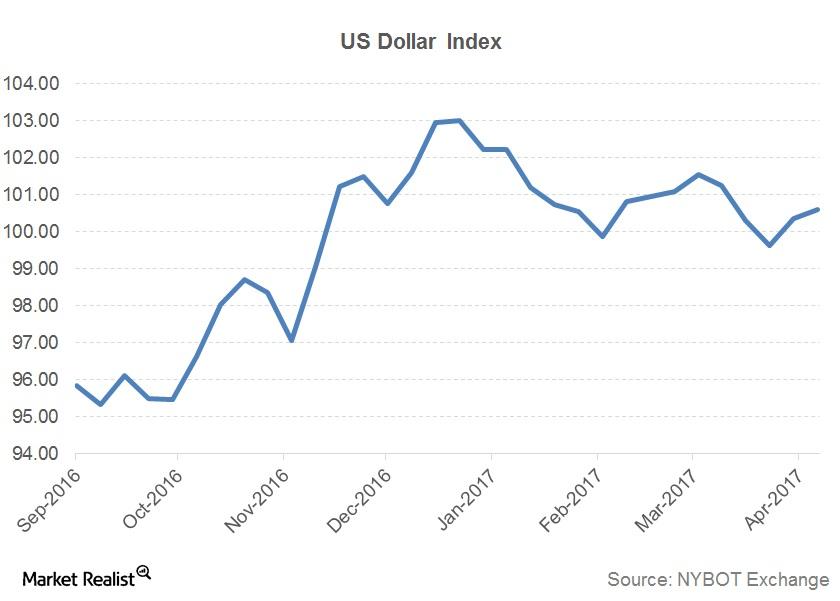

Will the US Dollar Rally?

After the election results were announced in the US, the Dollar Index (UUP) surged to levels above the 103 mark in anticipation of fiscal stimulus, tax breaks, improving economic conditions, and the possibility of rate hikes.

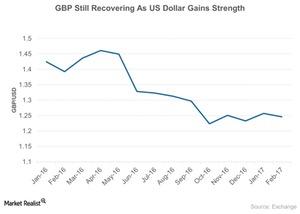

How Currencies Have Reacted since the Brexit Decision

The British pound (FXB) (GBB) is trading at 31-year low of 1.25 as of February 2017, its lowest level since 1985. The currency fell ~11% in 2016.