Is the US Dollar Dying a Slow Death?

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

Aug. 28 2017, Updated 3:08 p.m. ET

US dollar continued to fall

The US Dollar Index (UUP) returned to weakness in the previous week—it fell 0.73%. Economic data had little impact on the US dollar because investors remained focused on Fed Chair Janet Yellen’s speech at Jackson Hole. There weren’t any negative or positive surprises from Yellen. However, the lack of any concrete direction from Yellen left investors disappointed.

Yellen’s speech didn’t provide any new insights into the Fed’s view, which prompted investors to flock to the euro—despite ECB President Mario Draghi refraining from making any tightening comments. Even President Trump’s tax reform tease didn’t revive the US dollar last week. The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

Speculators add to short positions

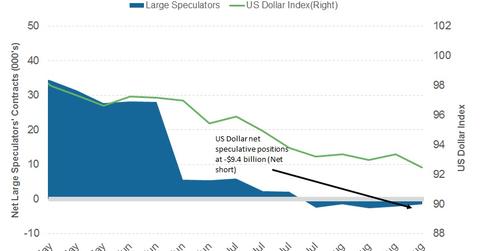

According to the latest “Commitment of Traders” report released on August 25 by the Commodity Futures Trading Commission, large speculators and traders increased their bearish positions on the US dollar.

According to Reuters’ calculations, the US dollar’s (USDU) net short positions rose to -$9.4 billion—compared to -$8.84 billion in the previous week. The amount is a combination of the US dollar’s contracts against the combined contracts of the euro (FXE), the pound (FXB), the yen (FXY), the Australian Dollar (FXA), the Canadian dollar (FXC), and the Swiss franc.

Week ahead for the US dollar

As we enter the last week of August, markets will be waiting for the August jobs report on Friday. Since liquidity is expected to remain low, even minor disappointments could lead to volatile market reactions. With no major economic data until Friday, currency markets will likely continue with the recent trends—more weakness in the US dollar. If there’s a rise in US political uncertainty, it would act as a catalyst to the US dollar’s weakness this week.

In the next part of this series, we’ll analyze how the bond market reacted to last week’s rise in risk aversion.