The Fed Could Announce Balance Sheet Reduction Plan in September

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet.

Aug. 18 2017, Updated 6:05 p.m. ET

Further discussions on balance sheet reduction plan

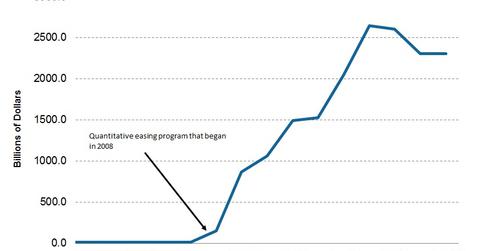

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet. During quantitative easing programs 1, 2, and 3, the Fed inflated its balance sheet from $2.5 trillion to the current size and now plans to slowly offload these securities. There would be gradually rising monthly offloading targets for different types of fixed income (BND) securities that the Fed holds on its balance sheet.

For US Treasuries (SHY) (IEI), the FOMC expects to let $6.0 billion roll off its balance sheet monthly and then increase that by $6.0 billion every quarter until it reaches $30.0 billion per month. For agency debt (MINT) and mortgage-backed securities (MBB), this cap would be $4.0 billion per month, rising $4.0 billion every quarter until a cap of $20.0 billion per month is reached.

Members felt the impact of the balance sheet reduction was minimal

FOMC members noted that the proposed balance sheet reduction program is expected to have only a minor impact on the overall monetary policy tightening plan. Participants agreed that considering the current economic conditions and the outlook, it would be appropriate to initiate the balance sheet reduction program. The announcement also implied that the next rate hike could be pushed further ahead.

Start date for balance sheet reduction may be announced in September

Some of the FOMC members were in favor of announcing a start date for the balance sheet reduction program, but most members preferred to defer the decision to the next meeting while they collected additional economic data. The markets are now expecting the FOMC to announce the commencement of the program in the next meeting, which will be held in September. There could be some adjustments to the plan outlined in the June meeting, but the balance sheet reduction program should begin this year.