Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.

Aug. 7 2017, Updated 7:36 a.m. ET

Short interest in Devon Energy stock

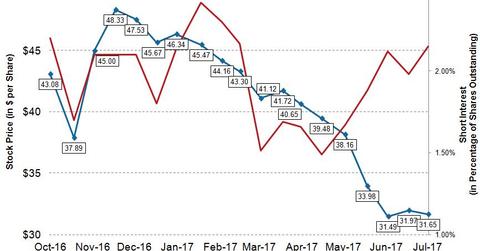

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million. The short interest ratio for Devon Energy stock is ~1.82x. The average daily volume is calculated for the short interest reporting period from July 1, 2017, to July 14, 2017.

- Devon Energy’s short interest ratio has a 52-week high of 3.35x and 52-week low of 1.55x.

- Devon Energy’s short interest as a percentage of its 20-day average volume, 90-day average volume, and 180-day average volume is 2.11x, 2.16x, and 2.30x, respectively.

- When the short interest is looked at from the perspective of shares outstanding, the current short interest in Devon Energy stock as a percentage of shares outstanding is ~2.2%.

- The short interest in Devon Energy’s stock as a percentage of shares outstanding is much lower compared to many other upstream stocks from the SPDR S&P Oil and Gas Exploration & Production ETF (XOP).

- As you can see in the above chart, the short interest in Devon Energy stock as a percentage of shares outstanding rose from ~1.8% to ~2.2% in 2017, despite an ~31% fall in Devon Energy’s stock price during the same period. To learn more about the recent price performance for Devon Energy stock, refer to Part 5 in this series.

Other upstream players

Marathon Oil (MRO) and W&T Offshore (WTI) have short interest as a percentage of shares outstanding of ~6.1% and ~7.4%, respectively. Just like Devon Energy, W&T Offshore and Marathon Oil saw an increase in their short interest in the last month. The Direxion Daily Energy Bull 3X ETF (ERX) is a leveraged ETF that invests in domestic companies from the energy sector.