What Rio Tinto’s Balance Sheet Means for Future Growth

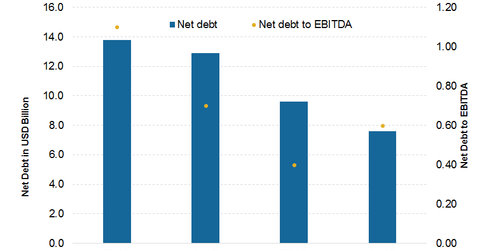

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

Nov. 20 2020, Updated 4:03 p.m. ET

Rio’s balance sheet strength

Since a strong balance sheet is necessary for a company to navigate the current volatile commodity price (COMT) environment, it’s important to look at a company’s financial leverage and balance sheet strength.

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

During 1H17, Rio improved its debt maturity profile. Its next bond maturity is now not due until 2020. Its $2.5 billion bond repurchase program has also brought forward its interest expenses, and this will likely lead to lower interest expenses going forward.

A competitive advantage?

Rio CFO (chief financial officer) Chris Lynch maintained during the company’s 1H17 earnings call that a strong balance sheet is a “major competitive advantage and appropriate, given the volatile pricing environments.”

Lynch also mentioned that a robust financial position enables Rio to do a balanced allocation of capital and supports greater cash returns to shareholders.

Rio’s financial leverage

Rio Tinto now has a net-debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) multiple of 0.6x. Peers (PICK) BHP Billiton (BHP), Freeport McMoran (FCX), and Vale (VALE) have higher financial leverages.

Overall, Rio’s balance sheet remains strong, and a dividend reset and capital expenditure cuts have provided it with additional flexibility to navigate the current volatility.