Prudential’s Discounted Valuations in 2Q17

Wall Street analysts recommended a one-year price target of $116.07 per share on Prudential Financial (PRU), reflecting an increase of ~14.1% from the current price.

Aug. 31 2017, Updated 7:36 a.m. ET

Lower valuations

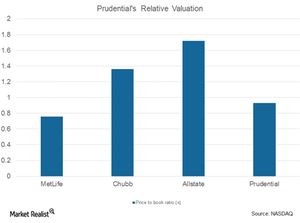

Wall Street analysts recommended a one-year price target of $116.07 per share on Prudential Financial (PRU), reflecting an increase of ~14.1% from its current price. Prudential’s peers’ average price-to-book ratio stood at ~1.3x, which is higher than Prudential’s price-to-book ratio of 0.93x.

Prudential currently has a lower valuation as a result of its individual life insurance business. Other insurance companies (IYF) have the following price-to-book ratios:

However, Prudential’s International business benefited in 2Q17, which is mainly due to underwriting margins and stable growth. The company’s management expects that the earnings in the company’s Retirement business could grow in the long term.

The company has been successful in rewarding shareholders, as it returned ~$640 million in 2Q17 with the help of buybacks and dividends. In 2Q17, Prudential Financial saw an increase in fee income in its Asset Management business and Individual Annuities business.