Eli Lilly’s Business Segments’ Performance in 1Q17

Elanco, Eli Lilly’s Animal Health business, reported growth of 2% to $769.4 million during 1Q17.

June 1 2017, Updated 10:37 a.m. ET

Business segments

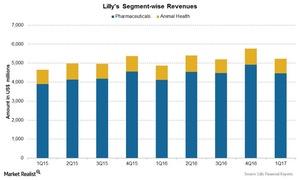

Eli Lilly & Co. (LLY) classifies its business into two segments: Human Pharmaceuticals and Animal Health. The Human Pharmaceuticals segment comprises ~85.3% of the company’s total revenues, while the Animal Health segment comprises ~14.7% of the company’s total revenues.

The chart below shows the revenues for the company’s business segments since 1Q15.

Human Pharmaceuticals segment

Eli Lilly’s Human Pharmaceuticals segment reported revenues of ~$4.5 billion during 1Q17, representing 8% growth compared to its 1Q16 revenues. The growth for this segment was driven by volume growth due to the strong sales of Cyramza, Erbitux, Jardiance, Humalog, and Trulicity. The segment’s growth was substantially offset by lower sales from Alimta, Cialis, Cymbalta, Humulin, and Zyprexa.

For Human Pharmaceuticals, the US markets reported a 16% increase in revenues due to growth in prices and volumes. The European markets saw a 5% increase as the growth in volumes and exchange rates was offset by lower realized prices.

Animal Health segment

Elanco, Eli Lilly’s Animal Health business, reported growth of 2% to $769.4 million during 1Q17. This growth was driven by increased sales in its companion animal products.

To divest company-specific risk, investors can consider the iShares Core High Dividend ETF (HDV), which holds 1.5% of its total assets in Eli Lilly. The iShares Core High Dividend ETF also holds 5.8% of its total assets in Johnson & Johnson (JNJ), 3.5% in Merck & Co. (MRK), and 4.9% in Pfizer (PFE).