New York Fed President William Dudley Discussed Inflation

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

Aug. 16 2017, Updated 4:36 p.m. ET

Dudley predicts slower inflation growth

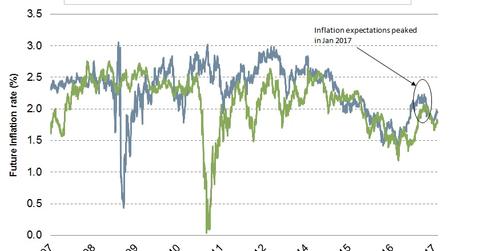

In his recent speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP). Dudley is a voting member of the FOMC this year. Dudley said that it would take some more time for inflation (VTIP) to rise to the 2% target level. He blamed the weaker dollar (UUP) for lower import prices. It’s the first instance recently that US dollar weakness has been mentioned as a concern. There were always complaints that the US dollar was too strong and it impacted US exports’ competitive advantage. In this case, Dudley was referring to the dollar’s weakness regarding inflation.

Concern about lower wage growth

Lower wage growth was also a concern for Dudley because it impacts inflation growth. Dudley said that sluggish US productivity limits wage growth. It was one of the key reasons that US inflation wasn’t rising despite unemployment reaching multi-decade lows.

Key takeaway

It’s evident that the FOMC members are concerned about the slowing US economy. The slower economy could translate to a slower pace of rate hikes in the near term. Growing geopolitical tensions between the US and North Korea could limit the Fed. Bond (BND) prices will likely improve if the Fed is expected to stay on hold. The US dollar (USDU) will remain under pressure if there aren’t any more rate hikes this year.