Inside Novartis’s 2Q17 Revenues

Novartis (NVS) reported flat revenues of $12.24 billion on a constant-currency basis for 2Q17. This included a 2% decline due to foreign exchange.

Aug. 30 2017, Updated 4:36 p.m. ET

Novartis’s revenues

Novartis (NVS) reported flat revenues of $12.24 billion on a constant-currency basis for 2Q17. This included a 2% decline due to foreign exchange. The company reports over 55% of its total revenues from outside US markets, and so it’s largely exposed to currency risk.

2Q17 revenues

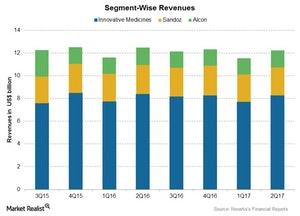

Novartis reported revenues of $12.24 billion in 2Q17—a 2% decline from 2Q16. Its Innovative Medicines segment reported 1% growth in operating revenues, while Alcon, its the eye care business, reported 3% growth in operating revenues. Sandoz, the generics pharmaceuticals business, reported a 4% decline in its operating revenues.

Novartis reported 6% volume growth, excluding the generics business and partially offset by a -3% impact of the lower sales of generics and a -3% impact of pricing due to the competition.

Revenues by segment

After its recent restructuring, NVS’s entire business is now segregated into three business segments: Innovative Medicines, Alcon, and Sandoz.

The Innovative Medicines segment includes two business units: Novartis Pharmaceuticals and Novartis Oncology. This segment reported revenues of $8.27 billion for 2Q17, compared with $8.39 billion in 2Q16. It reported nearly 1% operational growth, offset by a fall of ~2% due to foreign exchange. These revenues were mainly impacted by the lower sales of ophthalmic products.

Sandoz reported revenues of $2.45 billion for 2Q17, or 5% lower than its $2.58 billion in 2Q16. This includes a 4% fall in operating revenues, and a -1% fall due to foreign exchange.

Alcon reported revenues of $1.52 billion for 2Q17, compared with $1.51 billion in 2Q16. This includes ~3% growth in operating revenues, offset by a 1% decline from foreign exchange.

To divest company-specific risks, investors can consider ETFs like the First Trust Value Line Dividend ETF (FVD), which has 0.5% of its total assets in Novartis (NVS). FVD also has 0.5% in Bristol-Myers Squibb (BMY), 0.5% in Abbott Laboratories (ABT), and 0.5% in Merck (MRK).