Here’s Why the British Pound Could Be Headed for Further Losses

The British pound (FXB) was one of the worst performers in the week ending August 18.

Aug. 22 2017, Updated 10:36 a.m. ET

British pound continued its slide against the US dollar

The British pound (FXB) was one of the worst performers in the week ending August 18. The pound (GBB) posted a weekly loss of 1.05%, closing at 1.29 against the US dollar (UUP) as risk aversion arising out of the US and terrorist attacks in Spain dented sentiment. Economic data from the UK was positive with an uptick reported in retail sales for July, while the unemployment rate fell and average earnings increased. The impact of a weaker British pound on inflation (TIP) seems to have withered off as inflation came in below expectations.

British equity markets (BWX), especially the FTSE 100, managed to close the week with minor gains, despite a rise in risk aversion. The FTSE 100 Index posted a gain of 0.19% in the week ending August 18.

Speculators continued to reduce short positions

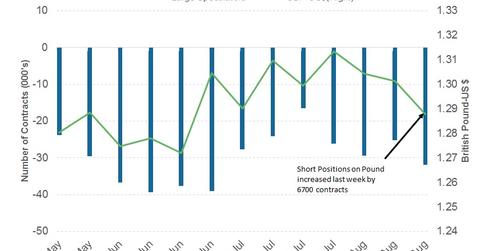

As per the latest Commitment of Traders (or COT) report, released on August 18 by the Chicago Futures Trading Commission (or CFTC), pound speculators have added 6,700 contracts against the British pound, taking the net short position to -31,860.

Will the British pound continue its slide?

The economic calendar from the UK is thin this week. Key data releases will include the second GDP estimate for the second quarter. The first estimate showed growth improving by only 0.3%, but the markets expect this reading to improve in the second estimate. After a sluggish growth of 0.2% in the first quarter and the continued uncertainty from Brexit, the Bank of England isn’t expected to tighten policy soon. The British pound remains weak fundamentally and is likely to depreciate further against the US dollar in the week ahead.