What Happened to the Eurozone Services PMI in July

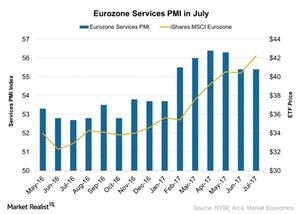

The Eurozone Services PMI remained unchanged in July 2017, coming in at 55.4 but missing the preliminary market estimation.

Aug. 17 2017, Updated 9:06 a.m. ET

The Eurozone Services PMI in July

According to a report by Markit Economics, the Eurozone Services PMI (purchasing managers’ index) remained unchanged in July 2017, coming in at 55.4—the same as in June 2017—but missing the preliminary market estimation. Among the member countries of the Eurozone, Germany (EWG), Spain (EWP), and France (EWQ) posted weaker service PMIs for July.

Since September 2016, we’ve seen that the Eurozone Services PMI had been on a constant rise up until May 2017. Then, in June 2017, the PMI showed a fall in performance. The softer performance in the PMI in July was mainly due to the following:

- Production volumes and output rose at a weaker pace in July.

- New business orders and export orders grew at a weaker pace.

- Employment growth slowed for the month.

Impact on the economy

The Eurozone economy has shown strong recovery in recent months, and improving economic conditions in the Eurozone has been strengthening investor’s confidence. Improvements in consumer demand, inflation, and the business climate have also been driving investor sentiment. However, in June and July, several economic indicators fell during the 2Q17 earnings season.

The iShares MSCI Eurozone ETF (EZU) and the Vanguard FTSE Europe ETF (VGK), which track the performance of the Eurozone (HEDJ) (FEZ) (IEV), rose ~3.4% and ~2.8%, respectively, in July.

In the next part, we’ll look at the UK Services PMI (EWU) for July 2017.