Will Market Shocks Really Be Minimal to Balance Sheet Unwinding?

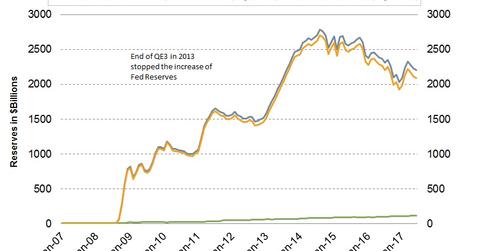

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet.

July 17 2017, Updated 9:09 a.m. ET

The Fed’s balance sheet bulge

In her testimony to the US House Financial Services Committee, US Federal Reserve Chair Janet Yellen answered questions regarding the proposed unwinding of the balance sheet. As part of its efforts to rescue the US economy from the financial crisis of 2008 and support the financial system (XLF), the Fed purchased huge quantities of fixed income securities (AGG) to help US yields (GOVT) and to rejuvenate the business climate in the US economy.

Securities were part of this bond buying program, as well as government-backed securities (TLT), mortgage-backed securities (MBG), and asset-backed securities (MBB). The Fed stopped buying new securities in August 2013 and has only been replacing expiring securities since then.

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet. The FOMC (Federal Open Market Committee) released some details of its plans to normalize its balance sheet.

Yellen says market shocks will be minimal

During her latest testimony, Yellen was questioned about the possible impact on markets from the unwinding of the balance sheet. She said that the Fed believes the market (BND) shocks will be minimal, as the process will be very slow and predictable.

FOMC plans for balance sheet unwinding

In the June FOMC policy statement and the Monetary Policy Report that was released before this testimony, the FOMC has revealed its plans for the balance sheet unwinding. The Fed intends to gradually reduce the reinvestment of principal payments it receives from the maturing securities.

The Fed has specified a cap for each form of security it holds. For US government treasuries, the cap will be $6 billion per month initially and will increase by $6 billion every three months, until it reaches $30 billion per month. For agency debt, the corresponding figures would be $4 billion and a max cap of $20 billion per month.

In the next part of this series, we’ll analyze why Yellen believes the US GDP will bounce back in 2Q17.