Could Marathon Petroleum’s Refining Earnings Rise in 1Q17?

Marathon Petroleum’s refining earnings are impacted by the blended LLS 6-3-2-1 crack, the sweet-sour differential, and the LLS-WTI spread.

March 14 2017, Updated 10:35 a.m. ET

MPC’s refining earnings indicator

In the previous part, we examined Tesoro’s (TSO) refining index values. Now, let’s look at Marathon Petroleum’s (MPC) refining earnings indicators.

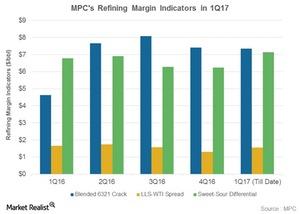

Marathon Petroleum’s refining earnings are impacted by the blended LLS 6-3-2-1 crack, the sweet-sour differential, and the LLS-WTI spread. According to MPC, a change of $1 per barrel in the blended LLS 6-3-2-1 crack affects its annual net income by $450 million. Similarly, a change of $1 per barrel in the sweet-sour and LLS-WTI spreads affects its income by $220 million and $90 million, respectively.

MPC’s refining margin indicators in 1Q17

In 1Q17 to date, Marathon Petroleum (MPC) notes that blended LLS crack has fallen by $0.10 per barrel quarter-over-quarter (over 4Q16) to $7.30 per barrel. However, the LLS-WTI spread and sweet-sour differential rose by $0.30 per barrel and $0.90 per barrel, respectively, over 4Q16 to $1.60 per barrel and $7.10 per barrel, respectively, in 1Q17 to date.

Thus, a marginal fall in blended LLS crack quarter-over-quarter is likely to be offset by a rise in LLS-WTI and sweet-sour differential. This points toward a possible increase in Marathon Petroleum’s refining earnings in 1Q17 over 4Q16.

Similarly, year-over-year, blended LLS crack has risen by $2.70 per barrel over 1Q16 to $7.30 per barrel in 1Q17. Also, the sweet-sour differential has grown by $0.40 per barrel YoY in 1Q17. However, the LLS-WTI spread has fallen by $0.10 per barrel YoY in the quarter.

Thus, the marginal fall in the LLS-WTI spread in 1Q17 over 1Q16 is likely to be offset by a rise in blended LLS crack and sweet-sour differential. This implies a likely rise in Marathon Petroleum’s refining earnings in 1Q17 over 1Q16.

The refining environment seems to be improving for Marathon Petroleum (MPC), as its refining earnings are likely to increase in 1Q17 YoY as well as quarter-over-quarter. If you’re interested in the refining sector, you can consider the iShares Global Energy ETF (IXC), which has ~5% exposure to the sector.

An improving refining environment also helps small refiners like Alon USA Energy (ALJ) and Western Refining (WNR). For exposure to small-cap stocks, you can consider the iShares Russell 2000 Value ETF (IWN), which has ~6% exposure to energy sector stocks, including ALJ and WNR.

In the final part of this series, we’ll look at Valero Energy’s (VLO) refining margin indicators in 1Q17.