What to Expect from Ericsson in 2Q17

Ericsson (ERIC) is expected to announce its 2Q17 results on July 18, 2017. Analysts expect Ericsson to post revenue of $5.7 billion with a low estimate of $5.6 billion and a high estimate of $5.8 billion for the quarter.

Dec. 4 2020, Updated 10:53 a.m. ET

Part 1: What Do Analysts Expect from Ericsson in 2Q17?

Revenue of $5.7 billion in 2Q17

Ericsson (ERIC) is expected to announce its 2Q17 results on July 18, 2017. Analysts expect Ericsson to post revenue of $5.7 billion with a low estimate of $5.6 billion and a high estimate of $5.8 billion for the quarter.

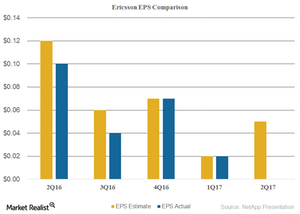

Ericsson’s non-GAAP (generally accepted accounting principles) earnings per share (or EPS) are expected to be $0.05 with a low estimate of $0.02 and a high estimate of $0.09 in 2Q17. If Ericsson meets analysts’ revenue estimate of ~$5.7 billion, it will mean a year-over-year (or YoY) fall of 10.9% compared to 2Q16.

Analysts expect Ericsson’s revenue to fall 6.5% in 3Q17 to $5.6 billion and 9.2% YoY in 2017 to $23.6 billion as well. As the above chart shows, Ericsson met analysts’ EPS estimate in 1Q17 and 4Q16 when the firm announced EPS of $0.02 and $0.07, respectively.

How did Ericsson perform in 1Q17?

In 1Q17, Ericsson reported revenue of 46.4 billion Swedish kronor (or SEK). However, the firm posted a net loss of 10.9 billion SEK in 1Q17 compared to a net loss of 8.3 billion SEK as estimated by analysts. Write-downs, reorganization costs, and provisions accounted for 13.4 billion SEK, or 29% of revenues, in 1Q17. In comparison, Ericsson’s net profit was 2.1 billion SEK in 1Q16.

Ericsson has a market cap of $23.5 billion. Nokia (NOK), IBM (IBM), and Cisco (CSCO) have market caps of $36 billion, $146 billion, and $155 billion, respectively.

Part 2: Cevian Capital Reveals Stake in Ericsson

Activist investor has $1 billion stake in Ericsson

In June 2017, Europe’s (EFA) largest activist investor, Cevian Capital, revealed a 5% stake in Ericsson (ERIC). According to SEC filings, Cevian has 168 million B-shares and 114,000 A-shares in Ericsson, which represents a 5% stake in the firm.

Cevian Capital’s managing partner, Christer Gardell, stated, “We have a long-term view, but when it comes to our patience we think that the improvements that need to be done must happen urgently. And in Ericsson’s case they should have been initiated yesterday.”

Ericsson stock has risen 24% in 2017

Ericsson stock has risen 24% since the start of 2017 after falling 2.4% in the trailing-12-month period and over 35% in 2016. Ericsson has been struggling with a weak macro environment and increasing competition from Huawei and Nokia (NOK) over the last few years.

The firm has also been unable to maintain profitability due to declining revenue. As we discussed earlier, Ericsson reported a net loss of 12.3 billion Swedish kronor (or SEK), or $1.4 billion, in 1Q17. Plus, in May 2017, Moody’s cut Ericsson’s credit rating to “junk,” as it believes that the firm’s cost-cutting strategy is not a long-term solution. Ericsson plans to improve its cost structure and aims to double operating margins in 2018.

Cevian Capital wants Ericsson to focus on core networks that are lucrative and will drive revenue in the long run. Ericsson stock rose over 6% on May 31, 2017, after Cevian’s stake in the company was made public.

Part 3: Will Ericsson Be Able to Improve Operating Margins?

Cost savings in 2017 and beyond

In 1Q17, Ericsson’s (ERIC) reorganization costs, provisions, and write-downs accounted for 29% of revenue. The firm’s operating margin fell to -26% in 1Q17 as well. Ericsson now aims to double its operating margin to approximately 12% in 2018 from 6% in 2016. Ericsson’s management isn’t satisfied with the company’s current cost structure.

Last July, Ericsson had stated that it will reduce operating expenses by 53 billion SEK (Swedish kronor) in the second half 2017. Ericsson, however, has said that the firm is unlikely to reach this target. Ericsson’s operating margin fell to 6% in 2016 from 11% in 2015 and 8% in 2014, driven by declining revenue and adjustments.

Sale of Media segment

Earlier this year, Ericsson announced that is looking to sell its loss-making Media segment. In 1Q17, Ericsson’s Media segment reported revenue of 2 billion SEK, a fall of 16% YoY (year-over-year) compared to revenue of 2.4 billion SEK in 1Q16. Operating margin in this segment also fell from -12% in 1Q16 to -51% in 1Q17.

Morgan Stanley (MS) has been hired to identify opportunities and explore the sale of this business, while Goldman Sachs (GS) has been appointed to find a buyer.

Part 4: Ericsson Is Struggling to Compete with Huawei

Huawei’s Carrier segment revenue rose 23% in 2016

China-based (FXI) Huawei is now the largest player in the telecom infrastructure space. Its Carrier segment posted revenue of approximately $42 billion in 2016, a rise of 23.6% YoY (year-over-year) compared to revenue of $34 billion in 2015. In comparison, peer companies Nokia (NOK) and Ericsson (ERIC) have annual revenues of $25 billion and $23 billion, respectively.

While Nokia and Ericsson are struggling to grow revenue, Huawei’s revenue in the telecom vertical has grown at a drastic pace. Further, Huawei’s revenue is expected to rise over 30% in 2017, whereas revenues for Ericsson and Nokia are expected to fall over 5% and 9%, respectively.

Huawei is also more profitable compared to Ericsson and Nokia. Huawei surpassed Ericsson as the largest telecom equipment vendor in 2012. In order to compete in the telecom space, Nokia acquired Alcatel-Lucent, and Ericsson has partnered with Cisco (CSCO) to provide various solutions in this segment.

Mobile infrastructure market

According to research firm IHS Markit, the global mobile infrastructure market fell 10% YoY to $43 billion in 2016 from $48 billion in 2015. While revenue in developed markets such as North America and Europe fell last year, emerging markets such as India and Africa saw revenue growth driven by LTE (long-term evolution) rollout.

Part 5: These Trends Could Drive Ericsson’s Revenue

LTE rollout

Although the 4G LTE (long-term evolution) rollout is almost complete in developed markets, there’s still potential for telecom firms such as Nokia (NOK), Ericsson (ERIC), Cisco (CSCO), and Huawei to target emerging economies in Southeast Asia and Africa as mobile operators look to enhance network coverage.

In the previous part of the series, we saw that the mobile infrastructure market fell 10% YoY (year-over-year) to $43 billion in 2016. The LTE market is also expected to fall at a CAGR (compound annual growth rate) of 12.4% from $25.9 billion in 2015 to $12 billion in 2021.

5G could launch in 2019, and rollouts on a large scale will likely begin by 2020. IHS Markit estimates the global 5G market will surpass $2 billion by 2021. 5G will likely be unable to offset the decline in LTE over the next four years, although 4G LTE subscribers are expected to exceed 4 billion in 2022.

New business opportunities

At the Mobile World Congress event earlier this year, mobile operator Vodafone (VOD) and Huawei showcased a fiber-based speed of ten gigabits per second. This broadband technology can be used in several technologies including virtual and augmented reality, 3D, 8K video, gaming, and big data downloading.

According to ABI Research, mobile traffic is expected to rise to 522 exabytes in 2022 from 109 exabytes in 2016. Mobile data consumption is expected to rise drastically as well from 1.2 GB per month per consumer in 2016 to 5.7 GB per month per consumer in 2022.

Part 6: How Is Ericsson Stock Performing in July 2017?

Stock returns

In the trailing-one-month period, Ericsson (ERIC) has generated returns of -1.1%. In the trailing-12-month period, the stock has fallen 2.4%. Ericsson’s stock has risen over 24% since the start of 2017 after falling 18% in 2015 and 37% in 2016. In the last five trading days, Ericsson stock rose 0.7% to close at $7.23 on July 5, 2017.

In comparison, US-based peers (SPY) Juniper Networks (JNPR), Cisco (CSCO), and Nokia (NOK) have generated returns of 28%, 9.8%, and 16%, respectively, in the trailing-12-month period.

Moving averages

On July 5, 2017, Ericsson closed the trading day at $7.23 per share. Based on this figure, here’s how the stock fared in terms of its moving averages:

- 8.6% above its 100-day moving average of $6.66

- 4.6% above its 50-day moving average of $6.91

- 1% above its 20-day moving average of $7.16

RSI and MACD

Ericsson’s moving average convergence divergence (or MACD) is 0.08. The MACD is the difference between a stock’s short-term and long-term moving averages. A positive MACD figure indicates an upward trading trend.

Ericsson’s 14-day RSI (relative strength index) is 56, which shows that its stock is somewhat overbought. Generally, if a firm’s RSI is above 70, it indicates that the stock has been overbought. An RSI under 30 suggests that a stock has been oversold.

Analyst recommendations

Out of the 12 analysts covering Ericsson (ERIC), three recommend a “buy,” and nine recommend a “hold.” There aren’t any “sell” recommendations.

Analysts recommended an average 12-month price target of $6.68 with a median target estimate of $6.40 for Ericsson. This suggests that Ericsson is trading at a premium of 11.5% to median target estimates.