What the ISM New Orders Index Indicates for the US Economy

The Institute of Supply Management (or ISM) New Orders Index indicates the number of new orders from customers.

July 24 2017, Updated 2:35 p.m. ET

About the ISM New Orders Index

The Institute of Supply Management (or ISM) New Orders Index indicates the number of new orders from customers. The ISM conducts a monthly survey to monitor changes in employment, production, inventories, supplier deliveries, and new orders. This is a monthly index that measures the number of participants who have reported increased customer orders compared to the previous month.

Such an index is also known as a diffusion index. An index reading of more than 50 indicates that the number of new orders has risen compared to the previous month. The Conference Board uses this index in constructing the Leading Economic Index (or LEI), as the level of new orders gives an idea of future economic growth.

Recent data released

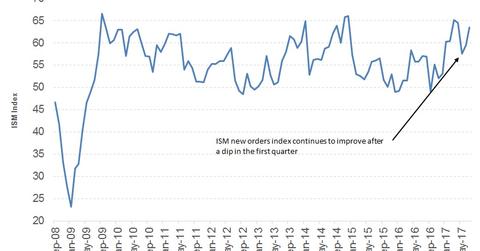

The ISM New Orders Index for June was 63.5, compared May’s reading of 59.5. The rise in the index gives hope to investors who were worried about the index’s fall from 64.5 in March to 57.5 in April. Continued growth in the ISM index is a positive sign for the US economy, and it could give the Federal Reserve the required ammunition to further tighten monetary policy. The ISM index had a net contribution of 0.17, or 17%, to The Conference Board LEI in June.

Market impact

The ISM New Orders Index is one of the first releases on the economic calendar each month, and it sets the tone for market action for the rest of the month.

Investors in equity (SPY) (QQQ), fixed income (BND) (IEF), and currency markets (UUP) should pay attention to this index. Continued growth is a sign of economic expansion, while a continued fall could mean future recession.