Housing Market: What a Rise in Building Permits Signals

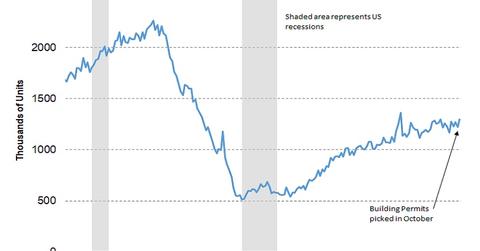

In October 2017, building permits were at a seasonally adjusted rate of 1.297 million—an increase of 5.9% from the reading of 1.225 million in September.

Nov. 22 2017, Updated 2:50 p.m. ET

Building permits and the housing industry

The housing industry’s (REM) health can be assessed from the changes in the number of building permits issued. An increase in the number of building permits is a signal for higher levels of future activity in the housing sector (ITB). However, building permits have a lower predictive power compared to the housing starts, which we discussed in Part 1 of this series. In October 2017, building permits were at a seasonally adjusted rate of 1.297 million—an increase of 5.9% from the reading of 1.225 million in September.

Single-family versus multi-family housing permits

In October, the number of permits for single-family homes rose 1.9% to 839,000 units—compared to a revised September reading of 823,000 units. The number of housing permits for multi-family units in October was reported at 416,000—compared to a revised September reading of 367,000 units.

From an economic point of view, the growth in single-family units is encouraging. It’s considered to have a better impact on the economy than multi-family units.

Company performance in the real estate sector

The October housing activity signals continued growth in the sector. It helps homebuilding companies impress the markets with their earnings. The National Association of Home Builders/Wells Fargo Housing Market Index report indicated an increase in homebuilder sentiment. The index measures homebuilder confidence based on sales expectations and prospective buyers for the next six months. The index rose to 70 in November—compared to a reading of 68 in October.

The companies in this space have appreciated considerably. KB Home (KBH) rose 83%, Lennar (LEN) rose 41%, and Toll Brothers (TOL) rose 54% in 2017. The sector’s outlook remains positive. The demand for residential units is expected to grow with the economy.