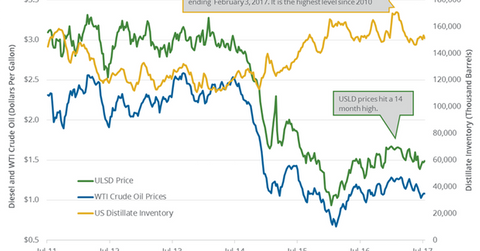

US Distillate Inventories Support Diesel and Crude Oil Futures

US distillate inventories fell for the third time in the last five weeks. Inventories fell 1.4% for the week ending July 14, 2017.

Nov. 20 2020, Updated 1:17 p.m. ET

US distillate inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on July 19, 2017. It reported that US distillate inventories fell by 2.1 MMbbls (million barrels) to 151.4 MMbbls on July 7–14, 2017. US distillate inventories fell for the third time in the last five weeks. Inventories fell 1.4% for the week ending July 14, 2017—compared to the previous week. Meanwhile, inventories fell 0.9% from the same period in 2016.

A Reuters survey estimated that distillate inventories would have risen by 1.2 MMbbls on July 7–14, 2017. The surprise fall in inventories supported US diesel futures on July 19, 2017. US diesel futures rose 1.8% to $1.53 per gallon on the same day. Inventories supported US crude oil (XES) (PXI) (USL) futures on July 19, 2017.

Higher crude oil and diesel prices have a positive impact on oil producers and refiners like Phillips 66 (PSX), Tesoro (TSO), Valero (VLO), Sanchez Energy (SN), and Goodrich Petroleum (GDP).

US distillate production, imports, and demand

US distillate production fell by 404,000 bpd (barrels per day), or 7.5%, to 4.9 MMbpd (million barrels per day) on July 7–14, 2017. Production fell by 59,000 bpd, or 1.2%, from the same period in 2016.

US distillate imports rose by 1,000 bpd to 126,000 bpd on July 7–14, 2017. Imports fell by 64,000 bpd, or 34%, from the same period in 2016.

Distillate demand rose by 476,000 bpd, or 12.3%, to 4.3 MMbpd on July 7–14, 2017. Demand rose by 414,000 bpd, or 10.6%, from the same period in 2016.

Impact

US distillates inventories fell below their five-year range. Inventories are expected to decline at this time of the year. The fall in distillate inventories would support diesel futures and crude oil prices.

To learn more about crude oil price forecasts, read US Crude Oil Futures Rose above 20-Day Moving Averages.

Read US and OECD Crude Oil Inventories Are Important for Oil Bulls and Crude Oil Market: Are the Bulls Taking Control? to learn more about crude oil.

You can also read Will Natural Gas Outperform in 2H17? for more on natural gas.