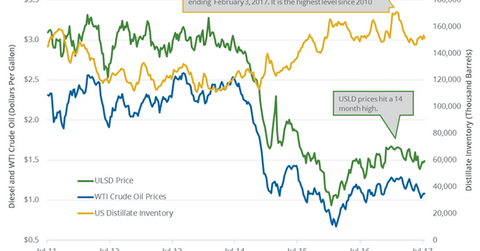

US Distillate Inventories Fell for the Fourth Time in 5 Weeks

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017.

Nov. 20 2020, Updated 10:52 a.m. ET

US distillate inventories

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017. Inventories fell 1.2% week-over-week and 1.6% YoY (year-over-year).

A market survey estimated that distillate inventories would have fallen by 0.5 MMbbls on July 14–21, 2017. A larger-than-expected fall in inventories supported US diesel futures on July 26, 2017. They rose 1.7% to $1.59 per gallon on July 26, 2017. US diesel and crude oil (USL) (PXI) (FXN) futures moved in the same direction on July 26, 2017.

Volatility in crude oil and diesel prices impacts oil producers and refiners like Valero (VLO), Western Refining (WNR), Marathon Petroleum (MPC), Chevron (CVX), Northern Oil & Gas (NOG), and QEP Resources (QEP).

US distillate production, imports, and demand

US distillate production rose by 186,000 bpd (barrels per day) to 5.1 MMbpd (million barrels per day) on July 14–21, 2017. Production rose 3.7% week-over-week and by 213,000 bpd or 4.3% YoY.

US distillate imports rose by 4,000 bpd to 130,000 bpd on July 14–21, 2017. Imports rose 3.2% week-over-week and by 37,000 bpd or 40% YoY.

Distillate demand rose by 42,000 bpd to 4.3 MMbpd on July 14–21, 2017. Demand rose 1% week-over-week and by 520,000 bpd or 13.5% YoY.

Impact

Inventories fell for the fourth time in the last five weeks. Inventories are also below the five-year range. An expectation of a fall in distillate inventories would support diesel futures and crude oil prices.

For more information on crude oil price forecasts, read Hedge Funds’ Net Long Positions in US Crude Oil Rose Again.

Read Crude Oil Market: Are the Bulls Overshadowing the Bears? and OPEC, Saudi Arabia, and the US Dollar Impact Crude Oil Prices to learn more about crude oil.

Read US Natural Gas Market: Exploring Investing Opportunities for more on natural gas.