Sluggish Mining Sector and Chile’s Trade Surplus in June

Chile’s economy is highly dependent on copper mining activities. The recent long strike at BHP Billiton’s Escondida copper mine continues to impact Chile.

July 14 2017, Updated 7:39 a.m. ET

Chile’s economy

Chile’s economy is highly dependent on its copper mining activities. The recent long strike at BHP Billiton’s (BHP) Escondida copper mine there continues to impact this Latin American economy in 2017. The mining sector is also seeing sluggish growth over the last few months.

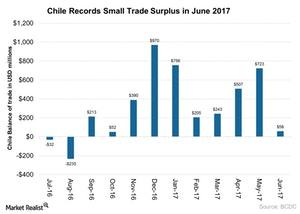

Chile’s trade surplus declined to $58.0 million in June 2017 compared to $723.0 million in the previous month and $375.0 million in the same period in the previous year.

In the graph below, you can see Chile’s trade surplus over the past year.

Trade balance in June 2017

Chile’s (ILF) trade surplus remained well below market expectations of $800.0 million in June 2017. Chile registered ten consecutive months of surplus, but the surplus in June 2017 was the lowest since October 2016. Imports increased at a higher pace than exports in June 2017 compared to the previous month, although imports remained below exports in June.

Exports stood at $5.3 billion in June 2017, a 12.8% rise year-over-year and a 7.0% rise month-over-month. Exports increased mainly for mining products, which had a 22.7% growth in production. Copper exports saw the highest increase of 27.7% in June 2017. Exports of agricultural, forestry, and fisheries rose 9.1%, and industrial products rose more slowly at 1.4%.

Imports stood at $5.2 billion, a 21.0% rise year-over-year and a 6.0% rise month-over-month. Imports rose mainly due to consumer goods, intermediate goods, and capital goods, which saw increases of 26.8%, 14.8%, and 29.5%, respectively, year-over-year.

Copper-dependent economy

The trade surplus in Chile over the years has been driven mainly by copper shipments. Some of the large copper-producing companies invested in Chile are BHP Billiton (BHP) and Antofagasta (ANTO).

The recent strike has affected copper exports in 2017, resulting in a reduced trade surplus for June 2017. Several mines in Chile also suspended production in June 2017 after heavy rains disrupted their operations.

Long-term view

Improvements in the global (ACWI) (VT) growth outlook and expansionary monetary policy are expected to support Chile’s economic growth in 2017. The economic activity index in May 2017 rose 1.3% compared to the same period last month. The mining index fell 4.6%, while the non-mining index rose 1.9%, driven by increased trade and manufacturing activity. The iShares MSCI Chile Capped (ECH) fell ~1.0% in June 2017.

Let’s look next at the Colombian economy in June.