iShares MSCI Chile ETF

Latest iShares MSCI Chile ETF News and Updates

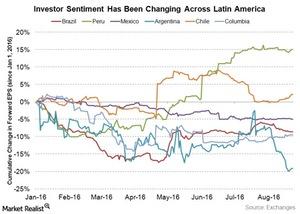

Investor Sentiment Favors Peru, Chile, and Brazil

Investor sentiment with respect to Latin American economies has definitely been changing since the beginning of the year.

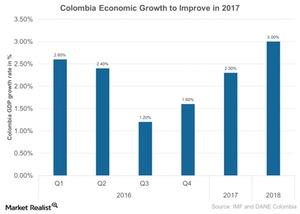

Why Colombian Stocks Are Surging in 2017

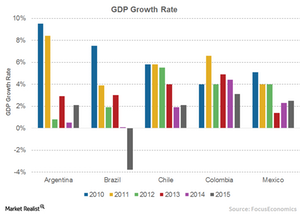

As the third-largest economy in Latin America, Colombia is expected to recover from its subdued growth of ~2% in 2016—its lowest figure since 2009.

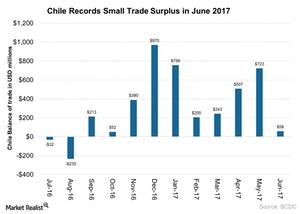

Sluggish Mining Sector and Chile’s Trade Surplus in June

Chile’s economy is highly dependent on copper mining activities. The recent long strike at BHP Billiton’s Escondida copper mine continues to impact Chile.

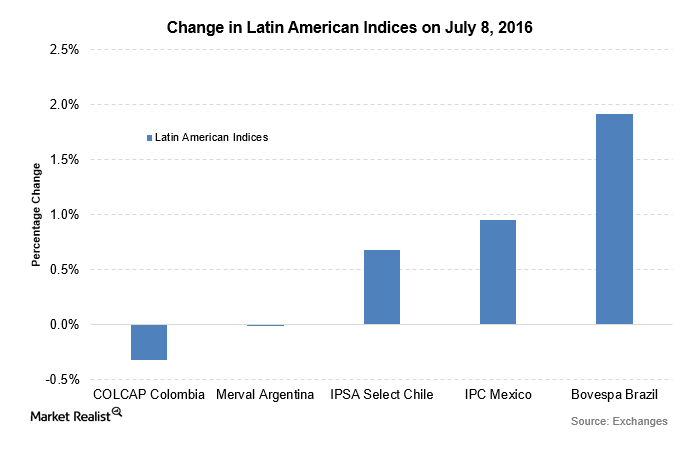

Latin American Markets Rise as Inflation Levels Ease in Brazil

Latin American markets were trading higher on July 9—taking cues from other emerging markets. Brazil’s inflation rate was released lower at 8.8% in June.

How Can Latin America Keep Up Inclusive Growth?

The Latin American (ILF) (EWW) economy contracted in the second half of 2015. The fourth quarter registered the biggest fall in six years.

How Mobile Banking Boosts Financial Inclusion in Latin America

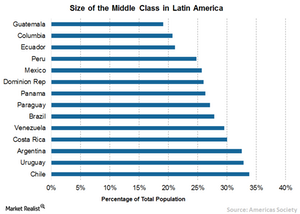

World Bank data reveal that since 2011, more than 60 million people in Latin America have opened bank and mobile money accounts.

How Disruptive Innovation Is Changing Latin America

Changing demographics in Latin America are driving innovations. Young people, which account for 25% of the total population, are more likely to accept innovation.

Chilean Peso Falls on Weak Economic Data

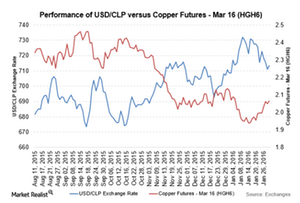

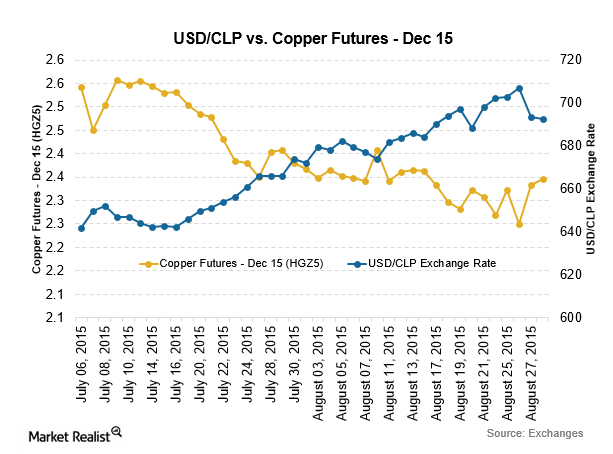

The Chilean peso depreciated against the US dollar on January 29, 2016, as reports indicated that copper production fell 5.5% in December 2015.

The High Correlation between the Chilean Peso and Copper Prices

Any variation in copper demand or supply directly affects the value of the Chilean peso against the US dollar.

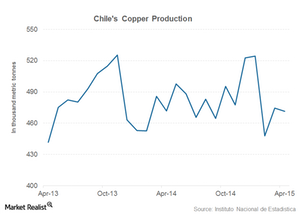

Copper Production in Peru, Chile Falls in First 3 Months of 2015

According to the World Bureau of Metal Statistics, Peru’s refined copper production declined in the first three months of the current year.

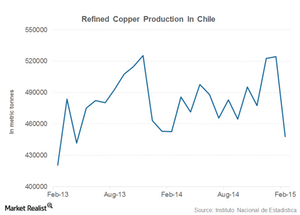

Chilean Refined Copper Production Falls to 2-Year Low

On a year-over-year basis, Chilean refined copper production fell by more than 1%. Incessant rains causing flooding are behind the decline in February’s copper production.