Johnson & Johnson’s Medical Devices Segment: 4Q17 Estimates

Johnson & Johnson’s (JNJ) Medical Devices segment includes products for specialty surgery, orthopedics, cardiovascular care, surgical care, diabetes care, and vision care.

Jan. 22 2018, Updated 9:02 a.m. ET

Medical Devices segment

Johnson & Johnson’s (JNJ) Medical Devices segment includes products for specialty surgery, orthopedics, cardiovascular care, surgical care, diabetes care, and vision care.

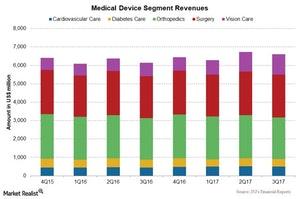

The above chart compares revenues for the Medical Devices segment over the last eight quarters.

Medical Devices brands

The Medical Devices segment includes the following brands:

- Animas Corporation: diabetes products

- Biosense Webster: advanced cardiac diagnostic, therapeutic, and mapping tools

- DePuy Synthes: orthopedic and neurological products

- Ethicon: surgical technologies and solutions, including sutures, staplers, trocars, and hemostats

- Janssen Diagnostics: diagnostic and health IT (information technology) solutions

- JNJ Vision Care: disposable contact lenses and eye care products

- LifeScan: OneTouch brand of blood glucose monitoring systems

- Mentor: global aesthetics products, including breast implants and facial aesthetics

Let’s look at the expectations for each of these franchise in the Medical Devices segment for 4Q17.

Cardiovascular care

Cardiovascular care is expected to report growth in revenues in 4Q17 due to the increase in sales of electrophysiology products, including the ThermoCool SmartTouch contact force sensing catheter.

Diabetes care

Diabetes care is expected to report a decline in revenues for 4Q17 due to pricing pressure and competition in self-monitoring blood glucose devices.

Orthopedics

The orthopedics franchise is expected to report growth in revenues for 4Q17 following the growth in hip and trauma products, partially offset by lower sales in knee and spine products.

Surgery

The surgery franchise is expected to report growth in revenues for 4Q17 following strong sales of general surgery products and advanced surgery products, partially offset by lower sales of specialty surgery products.

Vision care

The vision care franchise is expected to report growth in revenues for 4Q17 due to strong sales of contact lenses and the inclusion of Abbott Medical Optics.

The Health Care Select Sector SPDR ETF (XLV) holds 11.8% of its total investments in Johnson & Johnson (JNJ), 4% in Amgen (AMGN), 6.5% in Pfizer (PFE), and 5.1% in Merck & Co. (MRK).