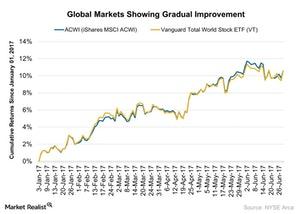

James Gorman Says the Global Economy Is Doing Well: Why?

Gorman believes the global economy is doing well in the present scenario. However, lower volatility is a major concern.

July 5 2017, Published 9:51 a.m. ET

Gorman’s view on the global economy

James Groman, CEO (chief executive officer) of Morgan Stanley, shared his views on the global economy (ACWI) in a recent interview with CNBC. He believes the global economy is doing well in the present scenario. However, lower volatility is a major concern.

Gorman on Europe

According to Gorman, Europe (VGK) (EZU) is doing pretty well in the current scenario. Major indicators for the Eurozone such as the services PMI (Purchasing Managers’ Index), the manufacturing PMI, the business sentiment index, economic growth, and inflation are showing improvement. Recently, the ECB (European Central Bank) also signaled a hawkish stance for the near future. It indicates that the risks that arose due to the deflationary environment are gradually decreasing.

Gorman on China and the US

Gorman also talked about the Chinese (FXI) (YINN) and US economies (QQQ) (SPY). Chinese regulators recently took steps to control credit growth. China is currently focusing on structural change. It’s shifting its focus from a manufacturing hub to a consumption-driven economy, which could be an important economic growth driver.

Gorman also said that the fundamentals for the United States are improving, as shown by the consumer confidence index. According to Gorman, as the world economy shows positive signs, the only risk could come from the political and geopolitical environment.

In the next part of this series, we’ll analyze Gorman’s view on the global bond yield.