What Investors Should Consider before Investing in REITs

A REIT (or real estate investment trust) is a company that owns and manages income-producing real estate.

Oct. 12 2017, Updated 11:18 a.m. ET

Risks potentially worth taking (Continued…..)

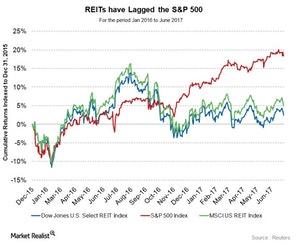

Real estate investment trusts (REITs): REITs became their own sector last year, but continue to be ignored by many professional investors. This group of stocks has lagged the S&P 500 since the middle of 2016. The principal reason for this is the concern that dividend-paying stocks will suffer from higher interest rates. We see good value in the sector, with many stocks trading at valuations below our estimate of the private market value of their assets. If interest rates rise due to higher levels of inflation, then hard asset values, including property, should benefit.

Conclusion

When investing for the long term, it is important to focus on both risks and return. In particular, investors should not add risk to their portfolios unless the potential for reward is also present.

Market Realist

Should you invest in REITs?

A REIT (or real estate investment trust) is a company that owns and manages income-producing real estate. REITs provide various benefits to investors that include liquidity, transparency, higher dividend yields, and simple tax treatment. Key among the benefits is diversification since real estate prices aren’t correlated to stock prices. The addition of REITs (ICF) can help form a diversified portfolio.

REITs are required to pay at least 90% of their taxable income to shareholders as dividends annually. This makes REITs an attractive asset class for income-seeking investors. However, investors fear that dividend-paying stocks could suffer when interest rates rise. REITs have lagged the S&P 500 (SPY) (SPX-Index) as shown in the chart above. The MSCI US REIT Index (VNQ) and the Dow Jones U.S. Select REIT Index (IYR) (SCHH) (RWR) have underperformed the S&P 500 between January 2016 and June 2017. The REIT indexes have risen 5% and 2%, respectively, while the S&P 500 returned 19% in the same period.

There have been three rate hikes since December 2016. In both March and June, the Fed raised interest rates by a quarter percentage point. Market participants think there’s a strong chance the Fed will raise interest rates one more time this year. The Fed aims to reach its targeted rate of 2% this year.

With an increase in interest rates, sectors with the highest amount of debt feel a little pressure. Companies that have a high dividend yield such as REITs usually have the heaviest debt burden. These companies’ profitabilities are sensitive to an increase in interest rates.

Nevertheless, there are other factors such as the job market, economic growth, demographics, occupancy rates and rent, and mortgage rates that also drive REIT performance.

It would be wise for investors to weigh the risk and return characteristics of each category before investing. A tactical allocation of assets in a diversified portfolio could benefit investors in the current economy.