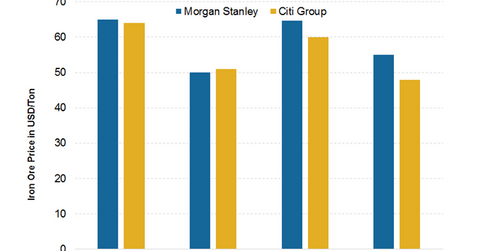

Analysts’ Views: What Iron Ore Price Could Bring Balance?

While iron ore prices have rebounded recently, analysts are still skeptical about the long term. Morgan Stanley has reduced its iron ore price forecast for 3Q17 by 23% to $50 per ton.

July 21 2017, Updated 3:05 p.m. ET

Morgan Stanley and Citi

While iron ore prices have rebounded recently, analysts are still skeptical about the long term. Morgan Stanley has reduced its iron ore price forecast for 3Q17 by 23% to $50 per ton.

Citigroup (C) believes that increasing supply and slowing Chinese demand will push iron ore prices (PICK) lower. The company believes that prices need to remain lower than $45 per ton for the market to rebalance.

Goldman Sachs

In a report dated June 29, 2017, Goldman Sachs (GS) wrote that iron ore prices would average $47 per ton next year. The brokerage maintains that if Chinese steel production growth holds at 4% for the rest of 2017, it still won’t be enough to balance the iron ore market.

Axiom, which is bearish on iron ore and steel, has suggested adding shorts in Cliffs Natural Resources (CLF), Rio Tinto (RIO), U.S. Steel (X), and Fortescue Metals Group (FSUGY) due to the expected bearish trend in iron ore prices.

Credit Suisse and Macquarie

Credit Suisse (CS) believes that iron ore prices should rise in the next few months backed by a seasonally strong period of steel production in China. It sees iron ore prices averaging $70 per ton over the next three months. The brokerage also feels that curbs in steel production in China should lead to higher steel prices and iron ore demand.

Macquarie Bank, on the other hand, believes that iron ore’s recent price rally above $60 per ton will reverse in the coming months. The bank mentioned that there’s a structural downside to prices as steel production falls from its current record levels in 2H17.

Macquarie believes that even if Chinese steel demand remains robust, there isn’t much upside for iron ore because supply remains plentiful. In this context, the bank sees iron ore prices falling below $50 per ton over the next six months to restore balance to the market.