Wall Street Recommendations and Price Target for Mosaic

Mosaic (MOS) remains a painful investment for investors. The company has delivered losses of 18.7% year-to-date as of July 13.

July 17 2017, Updated 10:41 a.m. ET

Mosaic

Mosaic (MOS) remains a painful investment for investors. The company has delivered losses of 18.7% year-to-date as of July 13. The company is one of the largest producers of phosphate fertilizers, and it also sells potash fertilizers through Canpotex, a marketing and distribution consortium held by Mosaic, PotashCorp (POT), and Agrium (AGU).

These North American companies (NANR) have come under pressure from Uralkali, Belaruskali, and Israel Chemicals (ICL) operating out of Europe and Asia.

Analysts’ ratings

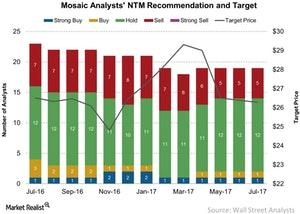

According to Reuters’ survey of 19 analysts, the mean rating on the stock is currently 3.1, which is slightly higher than PotashCorp and Agrium. However, the overall recommendation was still a “hold” on the stock for the next 12 months.

The overall recommendation on the stock remained unchanged month-over-month in July. One analyst had maintained a “strong buy” recommendation on the stock while one analyst had a “buy” recommendation on the stock for the next 12 months. Similarly, 12 analysts have maintained their “hold” recommendation, and five analysts have maintained a “sell” recommendation on the stock in July 2017.

Price target

As of July 13, the mean consensus price target for Mosaic stood at $26.2 to be achieved in the next 12 months. Analysts’ recommendation on the stock has remained unchanged month-over-month from $26.4. However, the median price target of the stock was $25.5, which would leave a return potential of 7% from the current price of $23.9 as of July 13, 2017.

However, the stock’s median price target was $25.5, which would leave a return potential of 7% from the current price of $23.9 as of July 13, 2017.

The companies mentioned above mainly focus on potash and phosphate fertilizers. Next, we turn our attention to CF Industries (CF), which is one of the largest producers of nitrogen fertilizers.