Why the Natural Gas Inventory Spread Supports Its Recent Recovery

In the week ended June 16, 2017, natural gas inventories rose 61 Bcf (billion cubic feet) to 2,770 Bcf based on EIA data released on June 22, 2017.

June 29 2017, Published 9:37 a.m. ET

Natural gas inventory data

In the week ended June 16, 2017, natural gas inventories rose 61 Bcf (billion cubic feet) to 2,770 Bcf based on EIA (U.S. Energy Information Administration) data released on June 22, 2017.

So far in this injection season, natural gas inventories have risen by an average of 65 Bcf, compared to 57 Bcf during the same period in 2016. An above-average rate of inventory additions could impact natural gas prices adversely.

Natural gas inventory spread

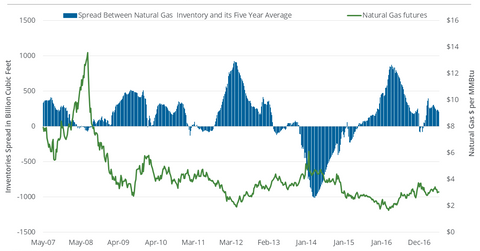

Natural gas (GASL) prices and the natural gas inventory spread usually move in opposite directions, as we can see in the graph above.

In February 2014, natural gas active futures closed above the $6 mark—a multiyear high. In March 2014, natural gas inventories fell more than 50% below their five-year average.

The inverse relationship between the natural gas inventory spread and natural gas prices could be important for the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3x ETF (DRIP), the iShares US Energy ETF (IYE), the Vanguard Energy ETF (VDE), the ProShares Ultra Oil & Gas ETF (DIG), and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

Natural gas inventory spread in the trailing week

Natural gas inventories rose above their five-year average in the week ended January 27, 2017. Since the switch, natural gas active futures have fallen 8.8%.

In the week ended June 9, 2017, natural gas inventories were 9.2% above their five-year average, and based on the most recent week’s data, they were 8.1% above their five-year average. The inventory spread fell on a week-over-week basis.

In fact, since the EIA released the natural gas inventory data for the week ended June 16, natural gas August futures have risen 6.1%.

Market forecast

The EIA will report natural gas inventory data for the week ended June 23, 2017, on June 29, 2017. Analysts expect natural gas inventories to rise 50 Bcf. In the week ended June 24, 2016, natural gas inventories rose 37 Bcf.