Why RSI levels of Mining Shares Are Rising

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

June 9 2017, Updated 9:07 a.m. ET

Mining stocks

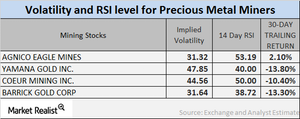

When analyzing the precious metals and mining companies in depth, we always have to look at variables that determine how attractive particular mining shares are or could become. The technicals that we’ll cover here include the 14-day RSI (relative strength index) and implied volatility.

Implied volatility

Implied volatility measures the comparative price changes in the price of a stock with respect to the price changes seen in its call option.

On June 6, 2017, the implied volatilities of Alamos Gold (AGI), Primero Mining (PPP), Silver Wheaton (SLW), and Franco-Nevada (FNV) stood at 51.1%, 90.6%, 30.8%, and 24.5%, respectively. Remember, mining company volatility is often greater than precious metal volatility.

RSI scores

The 14-day RSI measures whether an asset is oversold or overbought. An RSI number above 70 suggests a possible fall in price, while anything below 30 suggests a possible rise in price. The RSI figures of most major miners have risen over the past week due to upward price corrections.

Often, the RSI scores of mining stocks rise or fall when a company’s stock increases or decreases, respectively. Alamos, Primero, Silver Wheaton, and Franco-Nevada have RSI scores of 66, 27.4, 42.8, and 65.2, respectively.

Notably, investors can opt for precious metal leveraged funds like the ProShares Ultra Silver ETF (AGQ) and Direxion Daily Gold Exchange Fund (NUGT), which have risen 4.3% and 14.5%, respectively, on a 30-day-trailing basis.