Why Consumer Confidence in Argentina Is Falling in 2017

Argentina’s (FM) consumer confidence saw a huge drop in June 2017, as Argentinians are highly unsatisfied with the austerity measures President Macri’s government has adopted.

June 27 2017, Updated 1:05 p.m. ET

Argentina’s economic performance

Argentina’s (FM) consumer confidence saw a huge drop in June 2017, as Argentinians are highly unsatisfied with the austerity measures President Macri’s government has adopted. Argentina’s economy (ARGT) has seen a weak performance over the last decade mainly due to mismanagement by its former government. The economy has been contracting for the last few years amid high inflation and fiscal deficit. However, the economy is expected to advance at 2.2% in 2017 with President Mauricio Macri’s growth-oriented policies.

Let’s look at the consumer confidence in Argentina over the last year in the below chart.

Consumer confidence in June 2017

Consumer confidence in Argentina fell to 42.0 in June 2017 as compared to 45.8 in May 2017. The confidence level in June 2017 was the lowest in the last three months. Argentinian households were highly pessimistic about the country’s economic situation and their personal situation. Also, consumer intentions to purchase durable goods and properties were lower in June 2017. The confidence of both higher-income and lower-income sectors significantly worsened in June 2017 due in large part to austerity measures adopted by the new administration under President Macri.

Side effects of President Macri’s economic overhaul

President Macri’s effort to revamp the old policies with more stable economic policies has affected the jobs situation and inflation in 2017. The unemployment rate in Argentina has increased to 9.2% in 1Q17 from 7.6% in the previous quarter.

Considering the macroeconomic situation, the outlook for both the short term and long term has fallen 10.9% and 6.5%, respectively, as of June 2017. The perception of the current economic situation has also worsened by 7.7% as compared to the same period last year. As a result, the slower improvement in the economic recovery in 2017 is affecting consumer confidence.

Recently, Argentina’s central bank also announced it would keep its interest rate steady at 26.3% after its meeting on June 13, 2017. The central bank’s tightening stance might have further affected the already weaker consumer sentiment in June 2017.

Impact on Latin American region

Argentina’s economy provides a parallel to Brazil’s (EWZ) economy in 2017, which is currently facing a similar situation. Brazil (FBZ) is also facing lower consumer sentiment due to the austerity measures adopted by its government along with the political uncertainty. Latin American (ILF) market growth is majorly driven by these two large economies. Thus, any slowdown in these economies is likely to impact the growth of the Latin American region in 2017.

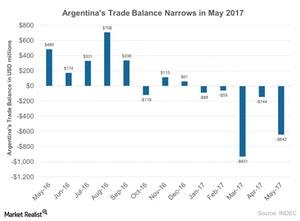

Let’s look at the balance of trade in Argentina in our next article.