First Quantum Minerals Ltd.

Latest First Quantum Minerals Ltd. News and Updates

Glencore or Freeport: Which Has More Upside Potential?

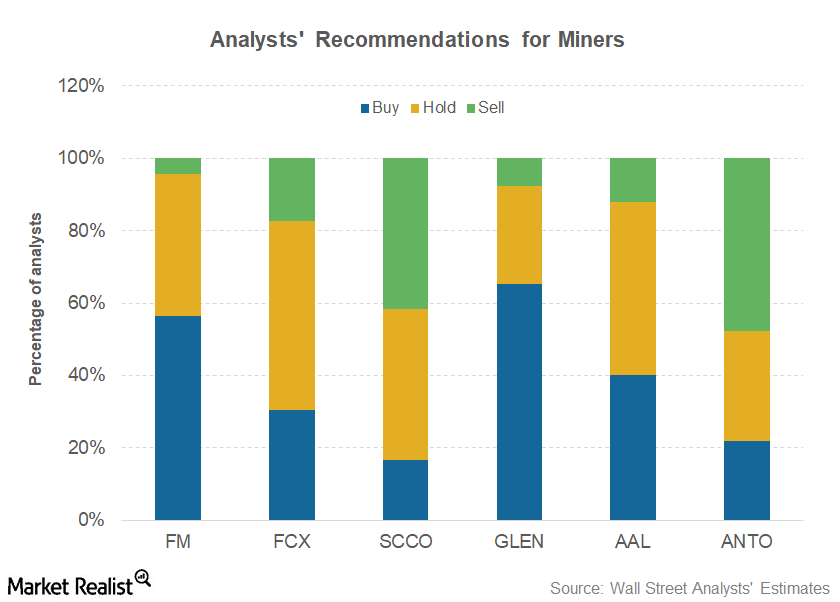

Glencore (GLEN-L) has the highest percentage of “buy” or higher recommendations in our select group of mining stocks.

Surge in Imports Increases Argentina’s Trade Deficit in May 2017

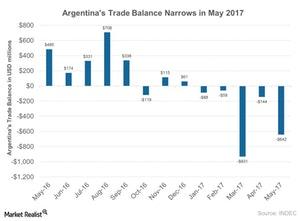

Argentina (ARGT) posted a higher trade deficit for May 2017 at $642 million, mainly due to increasing imports as compared to its exports.Financials Overview: The must-know characteristics of frontier markets

Looking for the next frontier in emerging market investing? Del Stafford dives into these underdeveloped countries to assess the investment case.

Why Consumer Confidence in Argentina Is Falling in 2017

Argentina’s (FM) consumer confidence saw a huge drop in June 2017, as Argentinians are highly unsatisfied with the austerity measures President Macri’s government has adopted.

Is Argentina Outperforming Emerging Markets in June 2017?

The Merval Index, Argentina’s benchmark index, has risen about 10.5% so far in 2017 as of June 23.