Performance of Eli Lilly’s Neuroscience Products in 2Q17

Cymbalta’s sales totaled $206.6 million during 2Q17, a 13.0% decline compared to sales of $236.5 million in 2Q16.

Sept. 4 2017, Updated 9:06 a.m. ET

Neuroscience franchise

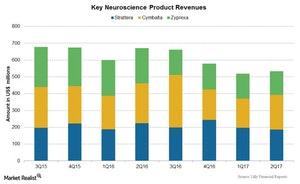

Eli Lilly & Co.’s (LLY) neuroscience franchise includes the drugs Cymbalta, Strattera, and Zyprexa. The chart below shows the revenues of its neuroscience drugs since 3Q15.

Cymbalta

Cymbalta is an antidepressant used for the treatment of depression and anxiety, as well as bone and muscle pain. Cymbalta’s sales totaled $206.6 million during 2Q17, a 13.0% decline compared to sales of $236.5 million in 2Q16. Its US sales fell 22.0% to $47.1 million, while its international sales fell 9.0% to $159.6 million during 2Q17.

Strattera

Strattera is a drug for attention-deficit/hyperactivity disorder (or ADHD). Strattera’s sales totaled $186.6 million during 2Q17, a 17.0% decline compared to sales of $224.6 million in 2Q16. Its US sales fell 29.0% to $101.5 million, while its international sales rose 5.0% to $85.1 million during 2Q17.

Zyprexa

Zyprexa is an antipsychotic drug used in the treatment of brain disorders like schizophrenia or bipolar disorders. Zyprexa’s sales reached $140.8 million during 2Q17, a 33.0% decrease compared to $210.7 million in 2Q16.

Zyprexa’s US sales fell 10.0% to $13.0 million, and its international sales fell 35.0% to $127.8 million during 2Q17. The drug’s international sales were impacted by patent expiry in Japan during June 2016, resulting in a 56.0% decline in sales from Japan due to generic competition.

For broad-based exposure to this sector, investors can consider the VanEck Vectors Pharmaceutical ETF (PPH), which holds 4.7% of its portfolio in Eli Lilly (LLY). PPH also holds 9.0% in Johnson & Johnson (JNJ), 5.2% in Merck & Co. (MRK), and 5.2% in Bristol-Myers Squibb (BMY).