New Kid in Town: Introducing TETF

Although the ETF industry posted stellar growth, no one thought of issuing an ETF dedicated to ETF providers. The gap was filled by TETF in April 2017.

Nov. 20 2020, Updated 2:04 p.m. ET

TETF

For investors looking to participate in this growth, the ETF Industry Exposure & Financial Services ETF (NYSE Arca: TETF), through unique tiered processes:

- Tier 1, 50% of the Index’s exposure, is made up of companies with substantial participation in the ETF industry, including BlackRock, Charles Schwab, Invesco, State Street, WisdomTree, and more.

- Tier 2, 25% of the index’s exposure, providing indirect financial impact to shareholders, including KCG Holdings, NASDAQ, Intercontinental Exchange, Inc., and more.

- Tier 3, 15% of the Index’s exposure, is made up of those companies with moderate levels of participation, including Bank of New York Mellon, US Bancorp, FactSet, Ameriprise Financial, and more.

- Tier 4, approximately 10% of the Index’s exposure, includes companies that are participating in a smaller way in the ETF industry relative to their overall focus, and includes such names as Morningstar, Eaton Vance, Goldman Sachs, Legg Mason, Citigroup, and more.

Market Realist

ETF dedicated to ETF providers

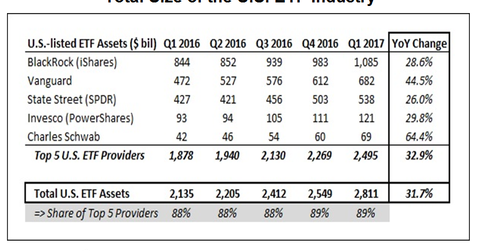

Investors can ride on stock market growth through ETFs (SPY) (IVV). Currently, the top five ETF providers in the US—BlackRock (BLK), Vanguard, State Street (STT), Invesco (IVZ), and Charles Schwab (SCHW)—account for more than 89% of all ETF assets. The top three providers account for 82% of the total assets. The top three ETF providers also control more than 70% of all ETF assets globally. The following chart shows the top five ETFs with their asset base and yearly growth.

The ETF Industry Exposure & Financial Services ETF

Although the ETF industry posted stellar growth, no one thought of issuing an ETF dedicated to ETF providers. The gap was filled by the launch of the Industry Exposure & Financial Services ETF (TETF) in April 2017. TETF tracks the Toroso ETF Industry Index, which is designed to measure and monitor the performance of companies deriving revenues from the ETF industry.

Since TETF tracks the Toroso ETF Industry Index, it gives investors targeted access to publicly traded companies in the US that generate substantial revenues from the entire ETF (VUG) ecosystem. According to Toroso Asset Management, apart from the ETF (SCHV) (VOO) industry, the portfolio includes index and data companies, trading and custody platforms, liquidity providers, and exchange operators. As shown in the above chart, the companies are categorized into four parts. Within each part, the constituent companies are weighted equally and rebalanced quarterly.