Insight into the Silver Market in June 2017

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

June 27 2017, Updated 9:26 a.m. ET

The dollar effect

Over the past five trading days, silver has seen the biggest drop among the four precious metals. Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively. Monday, June 19, was also negative for these precious metals.

The rise in the US dollar index, or the DXY Index, was one of the determinants driving precious metals lower. The DXY Index (UUP) has seen a five-day trailing rise of almost 0.42%. Silver is comparatively more volatile than gold, and its call implied volatility was 19.4%. Gold’s call implied volatility was close to 8%.

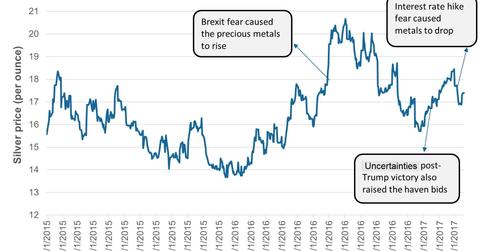

The above chart shows the price movement of silver over the past two years. Haven metals such as gold and silver are also used as a hedge against inflation, and their demands can surge given rising inflation.

Among the silver-based funds, the iShares Silver Trust ETF (SLV) and the Physical Silver Shares ETF (SIVR) have seen a YTD gain of 3.3% each.

Silver miners

The fluctuations in silver prices also affect silver mining companies such as Coeur Mining (CDE), Silver Wheaton (SLW), First Majestic Silver (AG), and Pan American Silver (PAAS). These four companies have also seen a drop in their stock prices over the past five trading days.

In our next article, we will look at the gold-silver spread.