Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

June 29 2017, Updated 4:05 p.m. ET

Platinum in diesel-based vehicles

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars as compared to diesel cars. While platinum is a famous precious metal used in jewelry, it’s also extensively used as a catalyst in diesel-based vehicles. The market demand for such vehicles plays a major role in the price fluctuations of platinum.

Just as the US dollar has been crucial in influencing the price changes of gold and silver, platinum has also been substantially impacted by changes in the dollar because it’s a dollar-based asset.

Platinum’s price has seen a marginal YTD (year-to-date) gain but has fallen ~4.6% in the past month. Platinum has fallen almost 60% from its peak in 2008.

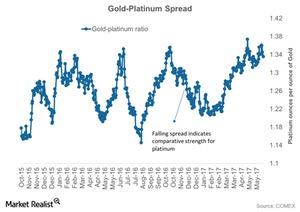

Gold-platinum ratio

When reading the platinum market, it’s important to analyze the comparative performance of platinum alongside gold by the gold-platinum ratio or spread. The spread measures the number of platinum ounces it takes to buy a single ounce of gold. The higher the spread surges, the weaker platinum (PPLT) becomes as compared to gold (IAU). A declining ratio indicates the relative strength of platinum over gold.

The gold-platinum spread was ~1.35 on June 27, 2017. The RSI (relative strength index) level for the gold-platinum spread is now 47.3.

Precious metal mining companies that rise and fall with these metals include New Gold (NGD), Franco-Nevada (FNV), Randgold Resources (GOLD), and Harmony Gold (HMY).